- Privacy-Policy

Race Mark Buoys for Triathlons, Sailing and other Competitive Water Races

- Custom Race Marks

- Tetrahedron & Tear Drop Race Marks

- Tomato and Cylinder Race Marks

- Triathlon Marks

- Accessories

- Inflation/Anchoring

- Maintenance

- Boat Race Committee Supplies

- Nautical Flags

- Race Committee Flags

- Alphabet Signal Flags

- International Signal Flags, Numerical Flags & Pennants

- Nautical Race Officer Flags

- Starter Flags

8 Foot Tetra Race Mark Buoy

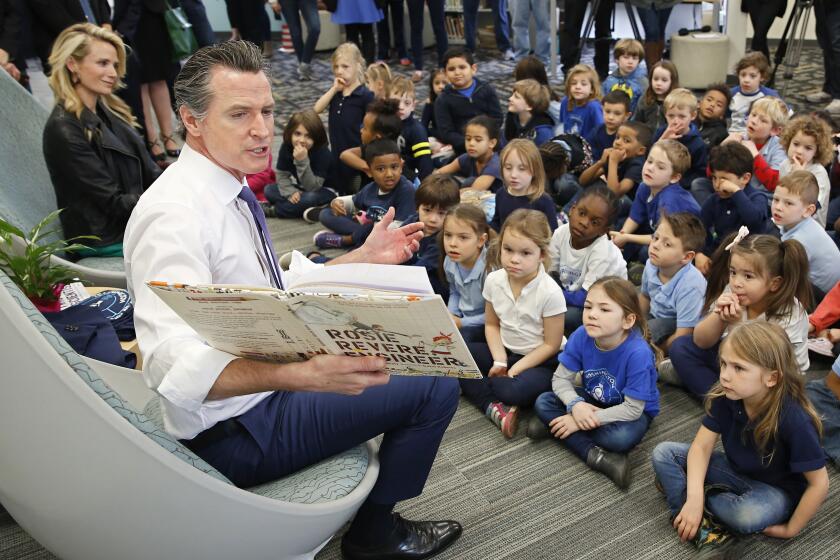

Yachts going by a Race Mark Buoy

Swim Across America

Nautical Flags And Race Committee Supplies

Race Marks Buoys, Signal Flags, Racing Supplies

Race supplies to the long distance swim & boats race communities..

ETP Race Mark buoys have been used in races both domestically and internationally for over 40 years. The inflatable race mark buoys are used for nautical events, yachts, stand up paddle board, dragon boat races, triathlons, swimming competitions, and more. ETP Race Marks is a custom fabricator and offers an array of shapes, sizes, colors, and even custom printing.

All ETP Race Mark’s inflatable buoys are constructed using a heavy duty 18 oz coated polyester fabric. These are marks are easy to inflate (see video ), use, deflate, and store. Each inflatable buoy must pass our 24-hour inflation test before shipment. The inflatable race mark buoys carry a one-year warranty. ETP Race Mark’s larger marks are equipped with a pressure relief valve to prevent over inflation. A dump valve addition is available to any buoy (3 feet or larger) to create a quicker deflation.

Our standard marks, include Tetrahedron, Tear Drop , Cylinder and Tomato shapes. Custom shapes and sizes are also available.

Most of the ETP Race Mark’s inflatable race mark buoys are anchored with stainless steel 3-5 D-ring system on the bottom of the buoy. ETP Race Mark’s does not provide anchor lines or weights but generally suggests using a mushroom anchor in lakes and Danforth anchors in larger bodies of water. Weight depends on the size of the buoy, but ETP Race Mark’s suggests 5 – 25 lbs. depending on the body of water was well as the size of the buoys. Always make sure there is plenty of slack in the anchor line.

A storage bag is provided for all buoys 3 feet or larger. ETP Race Marks does not provide bags for smaller marks. Standard colors are orange and yellow, however, other colors are available through special order. Custom sizes, logos, names, clear pockets, or sponsors’ advertisements are all possible options.

ETP also carries Race Committee supplies, International Signal flags, Pennants, Race Committee member flags & more.

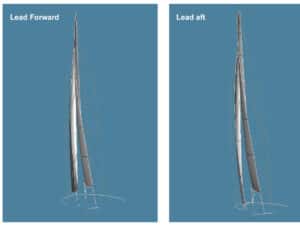

- YRA Description of Marks

Below are the descriptions of marks used in YRA races. Also included are the APPROXIMATE GPS coordinates for the permanent marks. These GPS coordinates are provided as a reference; the YRA makes no guarantee as to the accuracy of these GPS coordinates. We encourage you to sail by each mark and enter in your GPS to ensure accuracy.

Click here for ocean chartlet with marks.

Central & North Bay

Click here for Central Bay chartlet with marks, click here for North Bay chartlet with marks.

Click here for South Bay chartlet with marks.

- Become a YRA Member

- YRA Member Clubs

- Latest News

- The Great Vallejo Race

- Half Moon Bay Regatta

- Westpoint Regatta

- Encinal Regatta

- Shorthanded Sunday Series

- Doublehanded Midwinter Series

- Offshore Series

- The Bluewater Bash

- In The Bay Series

- YRA Master Calendar

- NCPHRF Rules & Guidelines

- Obtain an NCPHRF Certificate

- NCPHRF Ratings

- Certified NCPHRF Certificates

- PHRF Meetings

- YRA Buoy Status

- In The Bay Equipment Requirements

- Offshore Equipment Requirements

- US Sailing Protest Form

- Appeal’s Decisions

- Race Officers and Judges

- Race Committee Development

- USCG Permitting Process

- YRA MERCHANDISE

Dave Dellenbaugh Sailing

David Dellenbaugh is a champion helmsman, tactician, author, coach, rules expert and seminar leader who has spent his career helping sailors sail faster and smarter.Here are the learning resources that he has created to help you improve your racing skills.

- The SMART Course

Mark Roundings

Racing marks are turning points where all the boats in your fleet try to squeeze into one small spot. For this reason, mark roundings often produce large traffic jams, and the potential for gain or loss is great. With a bit of tactical knowledge, you can sail smarter than the others and, hopefully, turn most potential losses into gains.

Definition -- The rulebook defines a mark as any object that the sailing instructions say you must pass or round on a required side. This includes the ends of the starting and finishing lines, all the turning marks, government buoys that must be regarded, and so on. Whenever you are approaching a "mark," all the mark-rounding rules come into play, and these will have a large influence on your tactics.

When You're Ahead

At the weather mark, the biggest gains and losses are usually made just before you get there. So it pays to be very "smart" in your approach. A bit of tactical expertise will often improve your position relative to the competition and set yourself up well for the next leg

Unless you are converging with a boat on the opposite tack, the regular mark-room rules apply. This means that when two boats are approaching on the starboard layline, the leeward boat can get mark-room. The windward boat may be able to prevent this by reaching down and clamping on a tight cover. The idea is to give the leeward boat enough bad air so she falls astern before you get to the mark.

Frequently, a boat that's on the starboard layline (S) will converge with a port tacker (P) near the mark. P would usually like to tack on S's lee bow and beat her around the mark. To prevent this, S can often bear off a few degrees before she gets within two boatlengths of P. This effectively "closes the door" and forces P to take S's stern.

Starboard roundings -- A starboard rounding at the windward mark can get pretty messy, and that's why most race committees avoid this kind of course. If you find yourself on a starboard course, try to approach the windward mark on starboard tack. A port-tack boat is at a big disadvantage here, not only because starboard boats have the right of way, but because they can alter course as they round the mark.

To jibe or not to jibe -- When you come around the windward mark onto a run, the big question is whether you should do a bearaway set or a jibe set. This choice should be based on a combination of strategic and tactical factors. If port tack is favored on the run, or if you are in a right-hand shift as you come around the mark, a jibe set may be your best bet. This will also get you to the inside and is the best way to maintain clear air if there is a big group of boats behind.

A bearaway set, on the other hand, is the more conservative choice. It's much easier to maintain boatspeed during this set because you don't have to turn as sharply and the spinnaker set is not so complicated. You also stay on starboard tack, which gives you rights over half the boats still beating to windward. So unless you are sure that a jibe set is the right move, go with the tried-and-true bearaway.

Other considerations:

1) If possible, give yourself at least a few boatlengths on starboard tack before the mark so you will have time to get your spinnaker ready for the next leg.

2) Use your sails and crew weight to help the boat turn and bear off around the mark.

3) Remember that you have the right to turn onto a proper course to the next mark, even if this suddenly puts you on a collision course with non-right-of-way boats still on the beat.

The Jibe Mark

Rounding a jibe mark is usually a bit more straightforward than either a windward or leeward mark. However, there are a few tactical moves worth considering:

Getting or breaking an overlap -- When approaching a jibe mark, the leeward boat has an advantage because she will be inside at the mark. The key is maintaining that overlap until the two-boatlength circle. The windward boat can often break a small overlap by heading up just before the circle.

Jibe before the mark -- Like other roundings, the ideal course around a jibe mark is to swing wide and then cut close. The best way to do this is to complete your jibe (get the pole on the mast) before your bow gets to the mark. That way you can head up higher as soon as you get around. This will often let you sail over the top of other boats that have slipped low because of trouble with their spinnakers.

The "S" turn -- In heavy air, you have to modify your jibe slightly so that you steer a shallow "S" course. This keeps the boat from heeling too far to leeward just after the boom comes across.

The Leeward Mark

The primary goal for leeward mark roundings is to put yourself in a good position for starting the next beat. Obviously, your first choice is to round ahead of all the nearby boats, so you will have clear air. That's why it's worth fighting for an inside position as you approach the mark.

The ideal rounding -- Whenever possible, make a classic rounding where you swing wide on the near side and cut close on the far side. The object is to be on a closehauled course before your bow gets to the mark. This way you will not lose any distance to leeward as you start the beat.

If there is a boat close behind as you go around the mark, you may want to "stuff" slightly as you round. Pinch up above closehauled for about a boatlength to make sure your competitor cannot get clear air behind you. This will also keep open your option to tack. Be careful, however, of slowing too much and letting the other boat punch through to leeward.

If you are on the outside as you approach the leeward mark, swing wide to make an ideal (tactical) rounding. The object is to be slightly to windward of the other boat's transom as you go around the mark. One advantage you have is that the inside boat cannot make a tactical rounding -- she must take no more room than is required for a "seamanlike" rounding.

Planning Ahead -- One of the toughest situations in any race is when you come around the leeward mark right behind another boat. Your crew is usually scrambling around the boat, your boatspeed is minimal and you're in bad air. Now what should you do?

A good leeward mark rounding begins when you start thinking about your strategic plan for the upcoming beat. Has the wind been shifting? Where is the most velocity? Which side was favored on the first beat? You shuld answer all these questions and settle on a strategy well before you get to the leeward mark.

Once you have a strategy, you must execute your mark-rounding tactics in order to implement that strategy. You basically have three choices when there is a boat right ahead of you:

OPTION 1 -- Tack right around the mark: This is obviously a good tactic when you think the left side is favored. It's also a good way to get clear air quickly. However, there are two disadvantages. First, you must tack when you are going slowly and still recovering from the rounding. Second, you are tacking right into the bad air and/or water of the fleet behind. If possible, hold on for a few boatlengths before tacking to minimize interference from other boats.

OPTION 2 -- Continue on the hip of the boat ahead: If the boat ahead goes a little wide and you have a good rounding, you may be able to hold on in clear air. This is a good option because you don't give up any distance and you can continue right while maintaining the option to go left.

OPTION 3 -- Reach off for clear air to leeward: When the right side is heavily favored, the best way to get clear air may be to reach off below the boat ahead. This is much better than trying to pinch above his bad air. One of the times when this tactic works best is in light air when you are on the outside of a pack. Hold your spinnaker until the last moment and reach around with your air clear in front of the other boats. Of course, this tactic means you must sacrifice a good bit of distance to windward, so don't use it unless the strategic benefits will make up for this loss.

The Finish

As a famous old salt once said, "The race isn't over until it's over." One of the most demoralizing ways to end a race is to lose a close battle right at the finish line. When you work hard the whole race, you have to keep sailing smart all the way to the finish in order to assure your position. Here are some suggestions:

Upwind -- At an upwind finish, the favored end of the finish line is the end that's farther to leeward -- on the lower ladder rung. This is the opposite end that would be favored if this line were being used for starting. Note in this diagram that the white boat crosses ahead of the black boat, but the black boat gets to the finish line first because he goes for the favored pin end.

At almost every finish line, one end or the other is favored. Just as with the starting line, it's almost impossible to have a perfectly square line. That's why you should almost always finish right at one end. The farther you are from the favored end, the more distance and time you are giving up.

If you're not sure which end is favored, there are several things you can do:

1) Try to look at the finish line (if it is set) when you sail by it on other legs of the course.

2) Watch the boats ahead and see where they finish. Especially when two boats are close together, the chances are good that they will finish near the favored end.

3) Finish on the tack most nearly perpendicular to the finish line. If boats are finishing on port, the starboard end is favored, and vice versa.

4) Postpone your decision by staying inside the triangle that's between the laylines to each end. This way you will be able to get as close as possible to the line without overstanding either end. When you get to the intersection of the two laylines, simply head for the end that is closer.

Once you know which end is favored, think of that end as a weather mark with its two laylines. Ignore the other end of the line and its laylines to simplify matters. Of course, it's best to make your final approach on starboard tack, as that will give you right-of-way over nearby boats.

"Shooting" the line -- If you have a close finish with another boat(s), you should always shoot the line so you cross it perpendicularly. Begin shooting when you are one or two boatlengths to leeward of the line; this distance will vary depending on the ability of your particular boat to maintain its momentum in the existing wind and sea conditions.

Since you usually want to finish at one end of the line, you should shoot the line as close to this end as possible for close finishes. To do this, approach the line on a course that's one or two boatlengths to leeward of the layline to the favored end. This will allow you room to shoot the line and finish right at that end.

Downwind -- When you are finishing on a run, you follow most of the same principles for finishing on a beat. The favored end is now the one that's farther upwind -- on the higher ladder rung. Finish right at this end, and remember to "shoot," by bearing off perpendicular to the line, just before you get there.

- The Newsletter

- Current Issue

- See a Sample Issue

- Get a FREE Sample Issue

- Newsletter Index

- Renew Subscription

- Gift Subscriptions

- Order Back Issues

- Testimonials

- Contributors

- Get Promotional Issues

- Reprint Permission

- Free back Issues

- Speed & Smarts Gift Card

- Learn the Racing Rules

- Buy Racing Rules Course

- Contents List

- 8 Reasons to get ‘LTRR 2024’

- Sample Video

- Rule Quizzes

- Log in to your LTRR 2024

- Webinar Schedule

- Webinar Replays

- Webinar Description

- Instructors

- Seminar Testimonials

- Order Workbooks

- Host a Webinar

- Pay for Webinar

- Services Offered

- Coaching Resume

- Winning Tips

- Around the Buoys

- Smallboat Sailing

- The FAST Course

- Miscellaneous

Rule 18.2 – Giving Mark-Room: Racing Rules of Sailing 2021-2024

Our second installment on mark-room is Rule 18.2 – Giving Mark-Room. We covered Rule 18.1 separately and we’ll update Rules 18.3 and 18.4 in a future post.

In 2018, the Inland Lake Yachting Association (ILYA) and SailZing, LLC partnered on a Fair Sailing initiative. As part of this initiative, SailZing worked with the ILYA and UK Sailmakers to develop a series of articles on the rules. With the rules changes in 2021, SailZing is updating these articles and adding video summaries.

Our thanks to UK Sailmakers for generating the animated scenarios.

Rule 18.2 Video

Rule 18.2 – Giving Mark Room

“(a) When boats are overlapped the outside boat shall give the inside boat mark-room , unless rule 18.2(b) applies.

(b) If boats are overlapped when the first of them reaches the zone , the outside boat at that moment shall thereafter give the inside boat mark-room . If a boat is clear ahead when she reaches the zone , the boat clear astern at that moment shall thereafter give her mark-room .

(c) When a boat is required to give mark-room by rule 18.2(b),

(1) she shall continue to do so even if later an overlap is broken or a new overlap begins;

(2) if she becomes overlapped inside the boat entitled to mark-room , she shall also give that boat room to sail her proper course while they remain overlapped .

(d) Rules 18.2(b) and (c) cease to apply if the boat entitled to mark-room passes head to wind or leaves the zone .”

(e) If there is reasonable doubt that a boat obtained or broke an overlap in time, it shall be presumed that she did not.

(f) If a boat obtained an inside overlap from clear astern or by tacking to windward of the other boat and, from the time the overlap began, the outside boat has been unable to give mark-room , she is not required to give it.”

Definitions

Room for a boat to leave the mark on the required side. Also,

(a) room to sail to the mark when her proper course is to sail close to it, and

(b) room to round or pass the mark as necessary to sail the course without touching the mark .

However, mark-room for a boat does not include room to tack unless she is overlapped inside and to windward of the boat required to give mark-room and she would be fetching the mark after her tack. (Example of a situation that requires giving room to tack is shown at right.)

Previously-defined terms (click to refresh your memory): overlap, clear ahead, clear astern , zone , room , proper course

Rule 18.2 Key Points

- This rule applies at both the windward and leeward marks. We’ll cover windward mark situations when we cover Rule 18.3.

- If Rule 18 applies, then either Rule 18.2(a) or Rule 18.2(b) will apply. The most common situations involve Rule 18.2(b).

- The key to understanding Rule 18.2(b) is to think of a “snapshot” when the first boat enters the zone. If the first boat enters the zone clear ahead, she need not give mark room to boats that are clear astern.

- When a boat claims she obtained or broke an overlap in time, the claim must be well-supported. If there is reasonable doubt, the claim will not be accepted.

- Rule 18 “turns off” when mark-room has been given. This means satisfying all the required portions of the mark-room definition.

Rule 18.2 Change

The 2021 changes modified Rules 18.1 and 18.2 slightly. Rule 18.1 now states that Rule 18 turns off when mark-room has been given. This applies to the entire rule. The corresponding statement in Rule 18.2 was removed. See the markup for Rule 18.2 to the right.

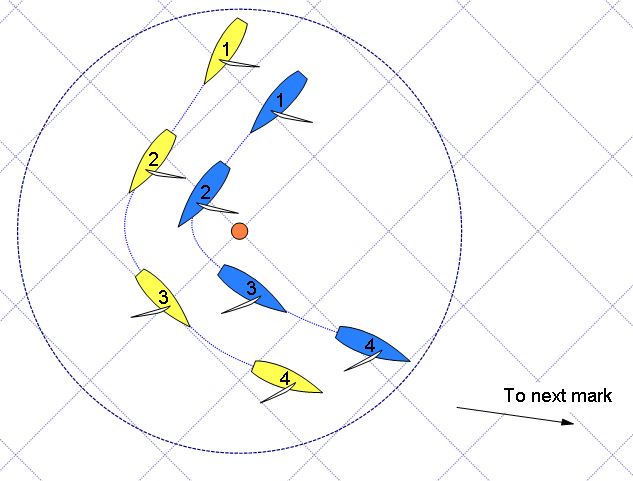

#1 – “Common Leeward Mark, Example 1”

Description: Yellow and Blue are sailing downwind on the same tack.

Should Yellow give mark-room to Blue? Answer

#2 – “Common Leeward Mark, Example 2”

Description: Yellow and Blue are sailing downwind on opposite tacks. When Blue enters the zone, she is clear ahead of Yellow. After entering the zone, Yellow becomes overlapped with Blue.

Should Blue give mark-room to Yellow? Answer

#3 – “Common Leeward Mark, Example 3”

Description: Yellow and Blue are sailing downwind on opposite tacks with spinnakers. Yellow reaches the mark first and does not give Blue mark-room. Blue heads up to avoid Yellow. There was no contact.

Should Yellow give mark-room to Blue? Answer

#4 – “Common Leeward Mark, Example 4”

Description: Yellow and Blue are sailing downwind on opposite tacks. Shortly after Yellow reaches the zone, Blue hails for room. Yellow does not respond verbally until reaching the mark, and then hails “no room.” Yellow does not give Blue mark room. Blue protests Yellow. Yellow alleges that she broke the overlap before she entered the zone. There was no contact.

Would a protest committee be likely to accept Yellow’s claim that she broke the overlap just before reaching the zone? Answer

#5 – “Common Leeward Mark, Example 5”

Description: Yellow and Blue are sailing downwind to the leeward gate on the same tack. After entering the zone, Blue turns up, sails faster, and breaks the overlap.

Should Blue give mark-room to Yellow? Answer

#6 – “Common Leeward Mark, Example 6”

Description: Yellow and Blue are sailing to the leeward mark. Blue is clear ahead when reaching the zone. Blue sails wide of the mark due to trouble with the spinnaker takedown. Yellow sails inside of Blue around the mark.

Is Yellow within her rights to round the mark inside Blue? Answer

#7 – “Common Leeward Mark, Example 7”

Description: Yellow, Blue, and Green are approaching the leeward mark. After entering the zone, Green slows down, but Blue speeds up and rounds inside of Yellow. Assume that Blue did not touch the mark. Yellow heads up and contacts Blue. There was no damage.

Which boat should promptly take a penalty? Answer

#8 – “Complex Leeward Mark”

Description: Multiple boats are approaching the leeward mark. Watch the scenario several times.

Is Yellow entitled to mark-room from Light Blue? Answer

Is Magenta entitled to mark-room from Green? Answer

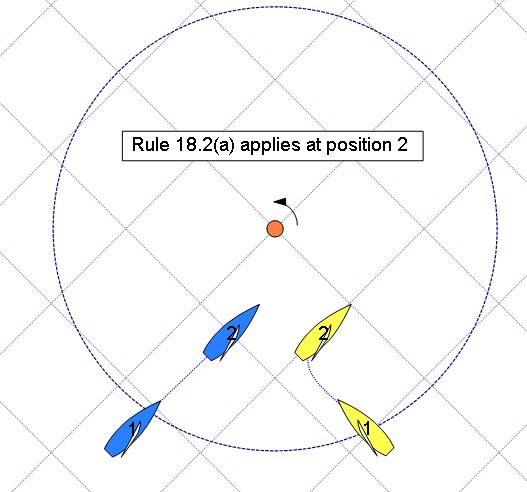

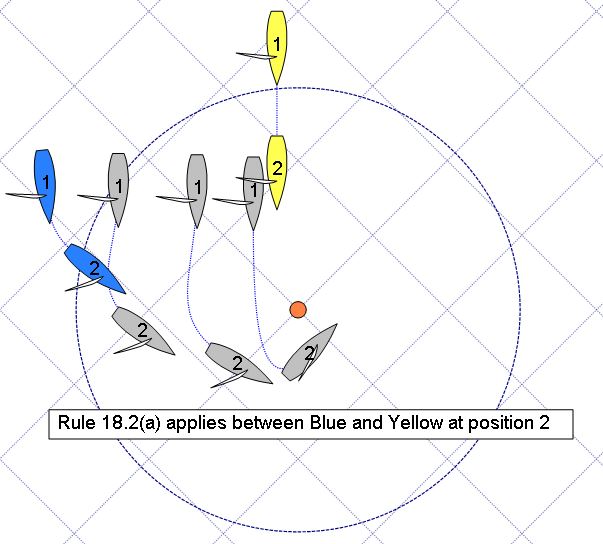

When does Rule 18.2(a) Apply?

We’ve covered the most common rule 18.2 scenarios, which are usually related to Rule 18.2(b) and the three boat length zone. So when does Rule 18.2a apply? Here are two examples.

On a beat to windward, recall that, in accordance with Rule 18.1, Rule 18 does not apply between boats on opposite tacks. If two boats are already in the zone, on opposite tacks, and then one of them tacks, Rule 18 begins to apply, In this situation, Rule 18.2(a) kicks in. In the example shown, once Yellow tacks to port, Blue is the inside boat and is overlapped, so Blue is entitled to mark room from yellow.

Here’s a leeward mark example, from Case 59 in the casebook. Blue is forced to sail outside the zone, due to the presence of the grey boats. Yellow is clear astern of Blue but enters the zone before Blue. Read Rule 18.2(b) carefully to see that it doesn’t apply here. Instead, Rule 18.2(a) begins to apply when Blue and Yellow are overlapped at position 2. Thus, Blue must give mark-room to Yellow.

World Sailing Cases of Interest

25 – When an inside overlapped windward boat that is entitled to mark-room takes more space than she is entitled to, she must keep clear of the outside leeward boat and the outside boat may luff provided she gives the inside boat room to keep clear.

59 – A boat abreast of a mark but outside the zone. Illustrates an application of Rule 18.2(a).

63 – At a mark, when space is available to a boat that is not entitled to it, she may, at her own risk, take advantage of the space.

70 – an inside overlapped windward boat that is entitled to mark-room from the outside boat must keep clear of thee outside boat and, if she is sailing outside of the mark-room to which she is entitled, she is not exonerated if she fails to keep clear.

75 – When an inside overlapped right-of-way boat must gybe at a mark, she is entitled to sail her proper course until she gybes.

Related Content:

SailZing – Racing Rules Category World Sailing Racing Rules of Sailing 2021-2024

Sailors Helping Sailors

Will you share your knowledge with your related Comments below?

Related Posts

ILYA #FairSailing – Rules Scenarios #1

ILYA #FairSailing – Rules Scenarios #2

ILYA #FairSailing – Rules Scenarios #3

Leave a comment cancel reply.

You must be logged in to post a comment.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Insert/edit link

Enter the destination URL

Or link to existing content

- AROUND THE SAILING WORLD

- BOAT OF THE YEAR

- Email Newsletters

- America’s Cup

- St. Petersburg

- Caribbean Championship

- Boating Safety

Sailboat Racing Tips: Rules at the Mark

- By Dave Reed

- April 26, 2022

Racing editor Mike Ingham delves into the intricacies of the Racing Rules of Sailing as they relate to rounding marks and how to get around clean.

- More: how to , rules , Sailboat Racing

- More How To

The Wisdom of Augie Diaz

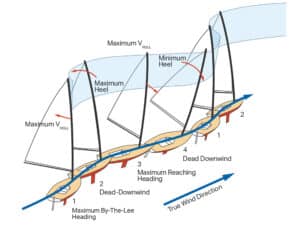

Why S-Turns, Roll Jibes and Roll Tacks Are Fast

The Path to Consistent Boatspeed

Headsail Trim Tips For Floating Leads

Wanderers of the Wayfarer Dinghy

Alinghi Red Bull Racing First to Reveal Its AC75

On the Line With US SailGP

Terhune’s Take On A Winning Streak

- Digital Edition

- Customer Service

- Privacy Policy

- Cruising World

- Sailing World

- Salt Water Sportsman

- Sport Fishing

- Wakeboarding

The Ultimate Guide to Yacht Racing Rules and Regulations

- by yachtman

- September 6, 2023 August 26, 2023

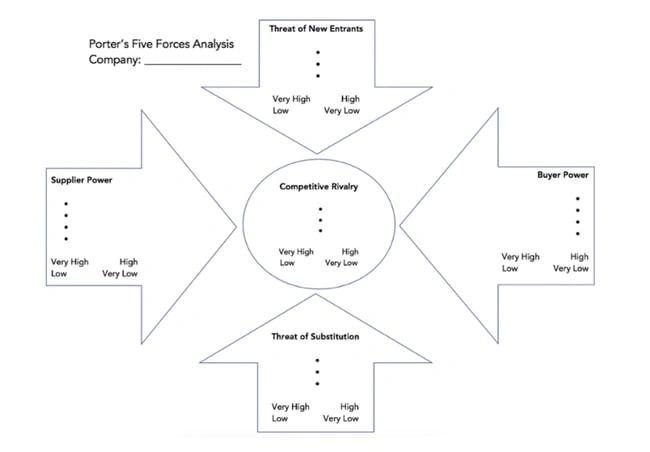

Yacht racing is an exciting sport! It requires skill, accuracy, and knowledge of rules . These regulations guarantee fair play and safety. To really appreciate the activity, you must understand the regulations.

At first, navigating the rules may seem intimidating. But breaking them down into chunks makes it easier. One important point is the hierarchy between boats. It shows which boat should give way in different situations.

It’s also important to know the race signals. They communicate crucial info, such as race starts and course changes. Participants and spectators need to know these.

Stay updated on any rule changes or amendments issued by World Sailing . They refine existing regulations and add new ones to improve the sport. Knowing the latest rules will give you confidence.

Finally, read case studies of past incidents/disputes during yacht races. This way you can learn from mistakes and be ready for unexpected situations.

Understanding the Basic Rules of Yacht Racing

Understanding the Fundamental Regulations of Yacht Racing

Yacht racing involves a set of basic rules and regulations that govern the competition. These rules are essential for ensuring fair play and safety on the water. To help you understand the fundamental regulations of yacht racing, here is a concise 5-step guide:

- Start Line Procedure: Before the race begins, all yachts must line up at the designated starting line. This line is typically marked by buoys or flags, and competitors must position themselves according to the rules specified by the race committee.

- Right of Way: Yacht racing follows a set of right-of-way rules that determine which yacht has precedence in certain situations. For example, a yacht on a starboard tack (wind coming from the right side) usually has right of way over a yacht on a port tack (wind coming from the left side).

- Mark Roundings: Yacht courses often include marks, such as buoys or flags, that competitors must round during the race. The rules specify how yachts should approach and pass these marks to ensure fair competition and prevent collisions.

- Protests and Penalties: If a competitor believes that another yacht has violated the rules, they can file a protest with the race committee. The committee will then investigate the incident and may impose penalties on the offending yacht if the protest is upheld.

- Finishing Line: The race concludes at the finishing line, which is typically marked by buoys or flags. Yachts must pass this line in the correct direction and often have to radio or signal their finish time to the race committee.

These steps outline the key elements of understanding the fundamental regulations of yacht racing. It’s important to familiarize yourself with these rules to ensure a safe and fair competition.

Pro Tip: Before participating in a yacht race, take the time to thoroughly study and understand the specific rules and regulations for that event. This will help you navigate the race effectively and avoid unnecessary penalties.

Get ready to navigate through a sea of confusing jargon as we dive into the essential terminology of yacht racing – it’s like learning a new language, but with more wind in your sails.

Essential Terminology in Yacht Racing

Yacht racing requires a unique language to be mastered by all sailors. Knowing these terms is essential for successful communication and cooperation during races.

Check out some of the key vocab words used in yacht racing:

Plus, other crucial terms like “luffing” (sail fluttering due to lack of wind), “tiller” (lever for steering boat) and “hull speed” (maximum speed a boat can reach in water).

Pro Tip: Get to know these essential yacht racing terms to up your enjoyment of this exciting sport!

Key Rules and Regulations for Yacht Racing

Yacht Racing: A Comprehensive Guide to Rules and Regulations

The rules and regulations governing yacht racing are crucial for ensuring fair and competitive events. Understanding these guidelines is essential for both participants and organizers to guarantee a level playing field and maintain the integrity of the sport. Below, we have compiled a table highlighting key rules and regulations for yacht racing in an easily accessible format.

Key Rules and Regulations for Yacht Racing:

These rules and regulations provide a framework that allows for fair competition and keeps participants safe. However, it is important to note that each race may have additional guidelines specific to the event or location, and participants should familiarize themselves with these unique details.

One such incident in the world of yacht racing involved a team that, due to a technical malfunction, found themselves adrift just moments after the race had begun. With quick thinking and teamwork, they managed to rectify the issue, rejoin the race, and ultimately finished in an impressive third place. This story illustrates the resilience and determination required in yacht racing, where unforeseen challenges can arise at any moment.

Yacht racing rules and regulations are comprehensive and necessary for maintaining fairness and safety. By adhering to these guidelines and being prepared for unexpected circumstances, participants can fully engage in the thrilling and competitive world of yacht racing.

Navigating through the racing course is like playing chess, except the pieces are yachts and the stakes are higher – imagine the drama when someone accidentally knocks over the queen!

Racing Course and Markings

Ahoy, mateys! Hop on board for a wild race on the high seas! It’s time to learn about the racing course : a carefully crafted area for a thrilling competition . Keep your eyes peeled for the start line – it marks the beginning of the race. Then, look out for the turn marks ; these designated points show where sailors must change direction. Finally, the finish line indicates the end of the race.

If ye want to be the best sailor, ye must understand these course and marking details. It’s essential for a successful yacht racing experience, so don’t miss out! Time to set sail and make your mark in the world of yacht racing.

Right of Way and Collision Avoidance

In yacht racing, we must pay close attention to the right of way and collision avoidance. Following specific rules and regulations is key to ensuring a fair race and preventing accidents.

Let’s look at the key rules related to right of way and collision avoidance in yacht racing:

These rules are just the beginning of the comprehensive regulations. Now, let’s look at a unique detail. In some cases, when two yachts on different tacks approach a mark, they may have equal rights. It’s important for skippers to communicate and coordinate to avoid possible collisions.

To show the importance of following these rules, here’s a story. During a competitive race, two yachts were nearing a turning point. The skipper of one boat did not yield the right of way, which violated rule number 10. Both boats were damaged and their chances of winning were ruined. This serves as a reminder that even small errors can have big consequences in yacht racing.

Starting and Finishing Procedures

Before the yacht race, boats must gather in the starting area. Skippers must steer clear of any collisions or rule-breaking.

Next comes the starting sequence – with flags or sound signals showing the time until the race starts. Skippers must pay close attention to them.

Once the final signal is given, the yachts race across the start line. Skippers must judge their entry properly to get an advantage and stay within the racing rules.

At the end of the race, the finish line is reached. Skippers should navigate and strategize here to cross it fast while following regulations.

Each race may have different start and finish procedures. Participants must read instructions from race organizers to stick to all rules.

The America’s Cup is one of the oldest sailing competitions. It began in 1851 around the Isle of Wight. It’s a big international event now, with teams competing every few years for the trophy.

Safety Guidelines for Yacht Racing

Safety Measures for Yacht Racing

Yacht racing events prioritize the safety of participants to prevent accidents and mishaps. Here are essential safety guidelines for yacht racing:

- Adhere to proper safety equipment regulations, including life jackets and distress signaling devices.

- Ensure all crew members are familiar with emergency procedures and know the location of safety equipment on the yacht.

- Maintain clear communication channels, using appropriate radio frequencies or signals during the race.

- Regularly inspect and maintain all equipment on board to ensure it is in proper working condition.

- Monitor weather conditions and take necessary precautions, such as altering course or seeking shelter in case of inclement weather.

- Adhere to collision-avoidance rules, maintaining a safe distance from other yachts and objects in the water.

It is important to stay up to date with the latest safety guidelines and regulations in the yacht racing community to ensure the well-being of all participants.

Yacht Racing Safety History:

Throughout the history of yacht racing, safety measures have evolved to enhance participant protection. Collaborations with maritime organizations and advances in technology have led to the development of comprehensive safety regulations and equipment. The efforts have significantly reduced the number of accidents and increased the safety of yacht racing as a sport.

Yacht racing may be a high-stakes sport, but remember, not everyone can pull off the bold fashion statement that is a life jacket.

Personal Safety Equipment

To ensure success in yacht races, it’s important to prioritize safety! All sailors should wear a well-fitted life jacket at all times to provide buoyancy aid. Personal locator beacons transmit distress signals if someone falls overboard. A harness with a tether will keep sailors attached to the boat. Protective clothing, such as gloves, boots and waterproof gear, guards against hypothermia and injuries. Reliable communication devices are necessary for crew members to stay in touch. Also, inspect all safety equipment regularly.

To further enhance safety, organizers can do regular safety drills. Employing support vessels is key for immediate response. Establishing clear communication protocols allows for effective coordination. By following these suggestions, yacht racers can reduce risks and maximize safety levels. Safety equipment and measures are essential elements for successful yacht races!

Safety Precautions on the Water

Yacht racing can be thrilling – but don’t forget to stay safe! Here are some essential tips:

- Always wear a life jacket : No matter how experienced you are, you can never be too careful.

- Check weather conditions: Sudden storms or high winds can make racing conditions dangerous.

- Create a communication plan: Make sure everyone in your crew is informed of any hazards or changes in course.

Plus, don’t forget to research local rules and regulations. Safety should always come first! So, gear up and get ready for a thrilling experience on the water. Enjoy the fun and camaraderie of yacht racing – just remember to stay safe!

Common Penalties and Protest Procedures

Yacht racing penalties and protest procedures involve various rules and regulations that must be followed. To ensure fair competition and resolve any disputes, there are consequences for violations. Here is a breakdown of the common penalties and the procedures for lodging a protest:

It’s important to note that each yacht race may have its specific procedures and penalties, so it’s crucial for participants to familiarize themselves with the rules beforehand. This ensures a fair and competitive environment for all racers.

Understanding the common penalties and protest procedures is vital for yacht racers to navigate the intricacies of the sport. By abiding by the rules and properly addressing any issues through the protest process, participants can ensure a level playing field, maintaining the integrity and fairness of yacht racing.

Don’t miss out on the opportunity to compete fairly and enjoy the thrilling experience of yacht racing. Familiarize yourself with the penalties and procedures to avoid any confusion or missed chances. Stay informed and make the most of your yacht racing journey.

“Being disqualified in yacht racing is like being told you’ve won the lottery, but then realizing it’s April Fool’s Day.”

Types of Penalties in Yacht Racing

Penalties in yacht racing are necessary to ensure fairness and compliance with the rules. These penalties act as a deterrent against any wrongdoings or rule-breaking, keeping the sport’s integrity intact.

A descriptive table can help us understand the various types of penalties in yacht racing:

These penalties have serious consequences, which act as a warning to sailors not to take any unfair advantages or act dangerously. Knowing these penalties is essential for competing in yacht racing.

Penalties have been part of yacht racing since the beginning. They were put in place to maintain order in races and create a fair playing field. Over time, these penalties have been adapted to fit the changing dynamics of the sport.

A good grasp of the penalties in yacht racing helps competitors perform better on the water. It also promotes sportsmanship and upholds the spirit of fair play in this exciting discipline.

Initiating and Resolving Protests

- Pinpoint the issue .

- Be sure it follows the rules.

- Gather data, facts, and material.

- Create a clear and concise statement.

- Submit the complaint to the right body.

- Talk to the parties.

- Look for a fair outcome through negotiation or mediation.

- Pay attention to deadlines.

- Respect protocols.

- Take charge and protect your rights.

- Act now and make sure your voice is heard!

Strategies and Tactics in Yacht Racing

Strategies and tactics are vital in the world of yacht racing. Understanding the nuances of this sport can make a significant difference in performance. Here, we explore some essential strategies and tactics employed by skilled yacht racers.

In yacht racing, there are unique details to consider, such as utilizing current knowledge to select the best racing route. Additionally, understanding the impact of tidal flows and currents can help racers make more informed decisions during a race.

To become a successful yacht racer, it is crucial to study and practice these strategies and tactics diligently. By mastering these techniques, one can maximize their chances of success and stay ahead of the competition.

Don’t miss out on the opportunity to excel in yacht racing. Enhance your skills by incorporating these strategies and tactics into your training regimen. Start implementing them today and take a step closer to becoming a champion on the water.

Positioning and Sail Trim Techniques: Where you’re positioned on the yacht may determine if you’re the first to cross the finish line or the first to take an unexpected dip in the water.

Positioning and Sail Trim Techniques

Table of Positioning & Sail Trim Techniques:

Plus, spinnaker handling has methods like gybing – shifting the spinnaker from one side to the other when sailing downwind. Helm balance is critical to good steering during racing.

Sir Ben Ainslie , a great sailor, said mastering positioning and sail trim techniques is the difference between successful racers and those who have difficulty competing in yacht racing events.

Reading Wind and Weather Conditions

Wind and weather conditions are essential for yacht racing. They let sailors make wise decisions, plan well, and have an edge. Here’s what to know about understanding these conditions:

- Observation – Skilled sailors look closely at wind direction, strength, and patterns. They keep an eye on clouds, waves, and temperature changes. By doing this, they can predict future weather shifts.

- Analyzing – Racers check forecasts, barometric readings, and sea temps. They combine this with their observations to get a clear picture of present and future winds.

- Adaptability – Successful sailors change their strategies with the changing conditions. They often reassess their tactics during the race, to take advantage of good winds or limit bad weather.

Yacht racers also think about local geography, tidal currents, and nearby landforms. This helps them sail complex courses accurately.

Sarah, a seasoned sailor , showed her skill in reading wind and weather conditions. Though she started in a difficult spot due to unfavorable winds, she noticed slight changes in the breeze. She used this knowledge to take risks while maneuvering her boat. Making smart decisions based on changing conditions, Sarah won in speed and tactics.

Reading wind and weather conditions is essential for yacht racers. With keen observation, data analysis, and flexibility, sailors can do well on the water. So, if you’re joining a regatta or a sailing trip, mastering this art is important for success.

Resources and Additional Information

The following section provides additional resources and information related to yacht racing rules and regulations. These resources can be helpful for further understanding and clarifying the various aspects of the sport.

- Visit reputable online platforms such as yacht racing associations, federations, and governing bodies for comprehensive rules and regulations.

- Explore websites that provide educational materials, instructional videos, and interactive tools to enhance your knowledge.

- Delve into specialized publications authored by renowned sailors, coaches, and officials. These books cover a wide range of topics, including racing tactics, strategies, and the intricacies of specific rules.

- Engage with fellow enthusiasts, experienced sailors, and professionals on sailing forums and online communities. These platforms offer valuable insights, practical tips, and discussions on various rules and racing scenarios.

It is essential to stay updated with the latest developments and amendments in the rules to ensure compliance and maintain fair competition. Continuously seek new sources of information to enhance your understanding of yacht racing regulations and improve your performance on the water.

Yacht racing rules and regulations have evolved over time to ensure fairness and safety in the sport. The sport’s history is replete with instances of rule modifications and adaptations to address emerging challenges and technological advancements. A testament to the sailing community’s commitment to maintaining a level playing field and promoting the spirit of competition.

Get ready to navigate through a sea of paperwork and bureaucracy as we dive into the world of associations and governing bodies—where bold sailors become masters of red tape.

Associations and Governing Bodies

Associations and Governing Bodies are vital for managing various industries. We present an overview of some important associations and governing bodies relevant to distinct sectors. To make it easier to understand, let’s list out the information in a table:

This table shows some examples of associations and governing bodies from many areas. Each association has a major role in setting up standards, creating rules, and promoting collaboration within its industry.

It’s worth noting that there are other associations and governing bodies in other places, each doing their part to foster growth and uphold ethical practices. These organizations often provide materials such as industry-particular research, networking chances, and professional growth programs.

Pro Tip: To stay up to date with the most recent developments in your field, participate actively in related associations or governing bodies. This can help you stay ahead and build valuable connections within your sector.

Recommended Reading and Online Sources

Unlock helpful resources to boost your knowledge! Try these ideas:

- Read up on industry news with Harvard Business Review .

- Learn new skills with Coursera or Udemy courses.

- Check out free materials from universities like MIT OpenCourseWare .

- Listen to inspiring TED Talks .

- Get answers in online forums and communities like Stack Overflow .

Go deeper with niche topics. Try IEEE Xplore or JSTOR databases for in-depth research. Master tough concepts with interactive learning platforms like Khan Academy .

Pro Tip: Don’t just consume info, engage with it. Take notes, join discussions, and apply what you learn.

Frequently Asked Questions

What is yacht racing?

Yacht racing is a competitive sport where sailboats or yachts compete against each other in a designated course to determine the fastest or most skillful boat.

What are the basic rules of yacht racing?

The basic rules of yacht racing include giving way to other boats, avoiding collisions, understanding right of way, and following course boundaries. Each race may also have specific rules and regulations.

How are yacht racing courses determined?

Yacht racing courses are determined by race organizers and can vary depending on the type of race and the location. Courses typically include marks, buoys, or specific geographic points that boats must navigate around.

What is the role of a race committee in yacht racing?

The race committee is responsible for organizing and overseeing yacht races. They set the course, establish starting and finishing lines, enforce rules, and ensure fair competition.

Do yacht racing rules change for different types of boats?

Yes, yacht racing rules can vary slightly depending on the class or type of boat. Different classes may have specific regulations regarding sail dimensions, equipment, or crew size.

How can I learn more about yacht racing rules and regulations?

To learn more about yacht racing rules and regulations, you can refer to official rulebooks such as the Racing Rules of Sailing published by World Sailing. You can also seek guidance from experienced sailors or enroll in sailing courses.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- EU STORE, IRELAND BASED | WORLDWIDE SHIPPING | FREE DELIVERY TO IRL & NI FOR ORDERS OVER €80

Racing Marks & Buoys

- Buoys & Markers

Plastimo 43404 Navigation Mark - Yellow

Plastimo Regatta Training Buoy

Optiparts Racing Mark - Ideal for Training and Clubs

Plastimo Rescue Buoy Yellow Horseshoe Buoy+Light

Plastimo Cylindrical Racing Mark - 1.5M x 0.9m 16448

Plastimo Replacement Cover Netting for Racing Mark - 1.5m Diameter 16445

Plastimo Spherical Racing Mark - 1.5M Diameter 16445

Crewsaver Pillow Buoyancy Bag 68L - 147 X 27cm

Crewsaver Racing Marks - Cylindrical Buoy 5ft x 2ft 6"

Crewsaver Racing Marks - Cylindrical Buoy 6ft x 2ft 6"

Crewsaver Racing Marks - Cylindrical Buoy - 4ft x 2ft

Plastimo Regatta Jumbo Marker Buoy - Height 3.2mx Base 2m

Polyform Fender Buoy A4 - White (75")

Polyform Fender Buoy A5 - White (100")

Polyform Marker Buoy A5 - Red (100")

Polyform Marker Buoy A6 - Red (110")

- Nautic House Marsh Rd Skibbereen Co. Cork Ireland P81 R230

- Call us on 021 4315700

About CH Marine

- Stores & Hours

Customer Service

- Brexit Notes

- Privacy Policy

- Returns Policy

- Terms & Conditions

- Shipping & Delivery Times

- Gift Certificates

- WEEE Recycling

Popular Brands

- International

- See all brands here

- Subscribe to our newsletter

Table of Contents

- because of foul weather,

- because of insufficient wind making it unlikely that any boat will Definition: Finish " data-url="/definitions/76?xformat=fleet" href="javascript:void(0)">finish within the race time limit,

- because a Definition: Mark " data-url="/definitions/70?xformat=fleet" href="javascript:void(0)">mark is missing or out of position, or

- for any other reason directly affecting the safety or fairness of the competition,

- a line the course requires boats to cross; or

- at a gate, between the gate Definition: Mark " data-url="/definitions/70?xformat=fleet" href="javascript:void(0)">marks .

- the new compass bearing or

- a green triangle for a change to starboard or a red rectangle for a change to port.

- Subsequent legs may be changed without further signalling to maintain the course shape.

- replace it in its correct position or substitute a new one of similar appearance, or

- prohibit a boat from competing unless she has broken rule Rule: 30.4 " data-url="/rules/1569?xformat=fleet" href="javascript:;">30.4 ; or

- cause a boat to be penalized except under rule Rule: 2 " data-url="/rules/1150?xformat=fleet" href="javascript:;">2 , Rule: 30.2 " data-url="/rules/1544?xformat=fleet" href="javascript:;">30.2 , Rule: 30.4 " data-url="/rules/1569?xformat=fleet" href="javascript:;">30.4 or Rule: 69 " data-url="/rules/1626?xformat=fleet" href="javascript:;">69 or under rule Rule: 14 " data-url="/rules/1320?xformat=fleet" href="javascript:;">14 when she has caused injury or serious damage.

Previous Versions

Last updated.

Race Mark Information

Poole harbour marks 2023, poole bay marks 2023, race mark sponsors.

ADVANCED SAILING RACE COURSE TECHNOLOGY

Simple, precise course setting with no anchors.

MarkSetBot is the world’s first and most advanced robotic sailing mark system

THE FUTURE OF SAILING RACE MANAGEMENT IS HERE

Set your course faster, more easily, and more accurately than ever before. the future of race management is here..

MarkSetBot offers robotic buoys and integrated course-setting technology for sailboat racing that makes race management simple, accurate and sustainable. Our patented robotic buoys are self-propelled and use GPS technology to hold position without anchors. With a user-friendly mobile app, easy assembly, and effortless routing and repositioning, they make precise race management simple.

Robotic Buoys

Add-on technology, why marksetbot, marksetbot helps clubs and organizations run races sustainably and efficiently with game-changing technology.

Fast course set-up with simple map design

Precise placement with quick repositioning

User friendly mobile app with off-grid remote

No anchor needed in deep water or high wind

Reduces environmental damage

Fully inflatable for easy transport and ASSEMBLY

Automated layout templates for 35+ courses

Comprehensive suite of supportive race management technology

Dedicated team supporting product delivery and innovation

ON-THE-WATER EXPERIENCE

MarkSetBot hardware and software have been honed since early 2014. Today, MarkSetBot is trusted by clubs worldwide and at all levels of events, from local weekday racing to world championship regattas. Our Bots have spent more than 32,000 days on the water and our app has been used in 39 countries.

GLOBAL REACH

MarkSetBot has an established network of dealers and distributors in Europe, Asia, Oceania and North America. From sales to Bot maintenance and event management, our dealers are here to support you and your Bot fleet.

THE EVENTS AND ORGANIZATIONS WE SERVE

Customers and partners.

MarkSetBot improves the quality and sustainability of racing, makes it possible to run more races in less time and results in happy racers and race committees.

"[MarkSetBot] has added a lot of quality to the racing. We don’t need to wait when we have a big wind shift as the marks can now be moved very efficiently, which ensures the competitors aren’t waiting a long time for the racing. Sometimes when the water is very deep, the mark layers need a lot of time to reset the course but with the robotic marks, it can be done very quickly. This makes it easier to get a higher degree of accuracy, and so the quality of the racing is much higher."

Maria Torrijo, Principal Race Officer, RC44 Cup

“The robotic racing marks from MarkSetBot proved their worth from the outset, not only protecting the seabed as part of ClubSwan Racing’s commitment to sustainability but also able to be easily repositioned to take account of windshifts.”

The Nations League Swan One Design

“I’m amazed at how accurate the MarkSetBots are. I noticed it when I was pinging the line. Every ping, they were in the same exact place. In shifty venues, you’re able to make course adjustments so easily by just pressing a button. It was very efficient and I think we were able to run races in conditions that otherwise would have been a lot more challenging and maybe not possible.”

Victor Diaz De Leon, Professional Sailor

“I recently did a Club-Swan 50 event and they used really cool self-propelled, no anchor GPS-controlled race marks – they were working in current and good breeze and waves and it made for simple racecourse adjustments and far fewer people needed to run the races. If you are a starting-line perfectionist PRO this gives you free reign to move the mark up to about five minutes before the start and still allow people to ping the pin.

Fewer people. Fewer anchor lines. Fewer boats needed. Less fuel.”

Ken Read, President, North Sails

LATEST FROM THE BLOG

Meet GolfShotBot, a dynamic floating golf target

Hitting biodegradable golf balls into the water is fun. Hitting them at a floating golf target...

Webinar: Unlocking the MarkSetBot Advantage

Whether you're a seasoned Bot Pro, considering bringing Bots to your course or just following...

M32s Bringing New Technology and New Blood to the Race Course

The M32 fleet has long been on the cutting-edge of sailing. First created in 2011, the M32 has...

LET’S TALK

Published on February 15th, 2021 | by Editor

Robotic Marks: Evaluating the issues

Published on February 15th, 2021 by Editor -->

Competition within sailing creates as much a community of racers as it does race volunteers. To host events, there is equipment to manage, courses to set, fleets to start and finish… it requires people with a passion for being on the water and working together.

Seeking to impact this paradigm and minimize the committee boats and people needed is the robotic mark industry. Using GPS tools and self-powered motors to accurately set the mark while eliminating anchoring… what’s not to like?

While our sport is good at seeking to improve itself, it is equally good at doing so at an ever increasing cost in time and money. A close evaluation of the current expense of running races, and how that would compare with robotic marks, is an important step in this process.

Three-time Olympian Chris Rast, who represents RoboMark , offers some of the additional issues to consider when looking at this evolution:

The robotic mark industry is now going into its 5th year since MarkSetBot introduced its first version. A quick google search will list the following companies that are now vying for your interest:

• MarkSetBot : The first robotic mark hit the racecourse in 2016, based in USA. • RoboMark : After successful, extensive trials, their first product, the RoboMark C1, is now being offered, based in Switzerland. • SMark : Watersportmarks, based in Switzerland, offers sMark, a smaller and handy mark. • SmartMark : Based on the original concept by Roboboj, based in Germany. • Roboboj : An early producer but seems like they aren’t really in the business anymore. They were in Switzerland. As with any other project, you need to do your homework first. Talk to your sailors, volunteers, race committee officials, the budget committee, and Racing Directors to develop an extensive list of Must-haves and Nice-to-haves. Here are some points you want to look at:

Venue: • What kind of wind and wave conditions will you use the marks? If it’s a windy place, you better ensure that the system has some substantial battery capacity. • Towing capability. If you need to tow your marks to the racecourse area and it is more than a mile away, you will want a design that is either small enough to bring on board or that allows you to easily tow it at faster speeds. • Pricing. What kind of business model suits you best? Would you just want to buy a complete set or have a yearly rental agreement? • Warranty and maintenance agreements. How are claims made, how long does the warranty last, how are the robotic marks serviced? What maintenance do they require? • Who at your club will oversee them and where/how will they be stored? • Launching and retrieving the marks. What are the possibilities at your club? How easy is it to handle the robotic mark onshore? • Regulations. Check with your local authorities and government agencies for what requirements you need to fulfill to use robotic marks in your area legally. This can include drone and/or simple remote-controlled water vehicle regulations. Be aware that you are responsible for using this remotely controlled vehicle and it always needs to be in sight of the user. • Networking capabilities. Most robotic marks use a mobile network for controlling. This sounds great until suddenly there are no more bars on your phone. If you have sketchy/weak reception, you might want to choose a system that works on a closed WIFI Network, so you aren’t dependent on mobile reception.

Event/ Regatta: • How many robotic marks do you need? Depending on the courses and how many classes you usually sail, you will need a certain number of marks. Just remember, you can quickly reposition robotic marks so that a starting line can easily become a leeward gate. • Branding. You might want the possibility of branding your marks with a sponsor or other signage. On some designs, this will mean added wind resistance, so make sure they have enough power and battery capacity to do their job for several hours in 20 knots.

Products: • What functionalities does the robotic mark application need to have? Pre-set courses, battery status, and time indication until all robotic marks are in their respective positions are useful functions. • Transport concept. If you are traveling a lot with the whole system, you will want to ensure that everything packs up nicely. • Batteries. Make sure the provided batteries can power the robotic mark without any problems. Most designs don’t allow for easy swapping on the water. How long do they take to fully charge? • Plan B. What are the options if the remote-control fails? Can you position the robotic mark by pressing a button on itself? Or can you at least attach some tackle and a weight? • What other special functions can the robotic mark offer? Wind sensors, joystick function, horn signals, etc.

Tags: Chris Rast , RoboMark , robot marks , robotic

Related Posts

Hold Fast: An Olympic Sailing Podcast →

Robots to invade Block Island Sound →

VIDEO: What To Do as Puffs Come and Go →

Robot Sailboats Scour the Oceans for Data →

© 2024 Scuttlebutt Sailing News. Inbox Communications, Inc. All Rights Reserved. made by VSSL Agency .

- Privacy Statement

- Advertise With Us

Get Your Sailing News Fix!

Your download by email.

- Your Name...

- Your Email... *

- Email This field is for validation purposes and should be left unchanged.

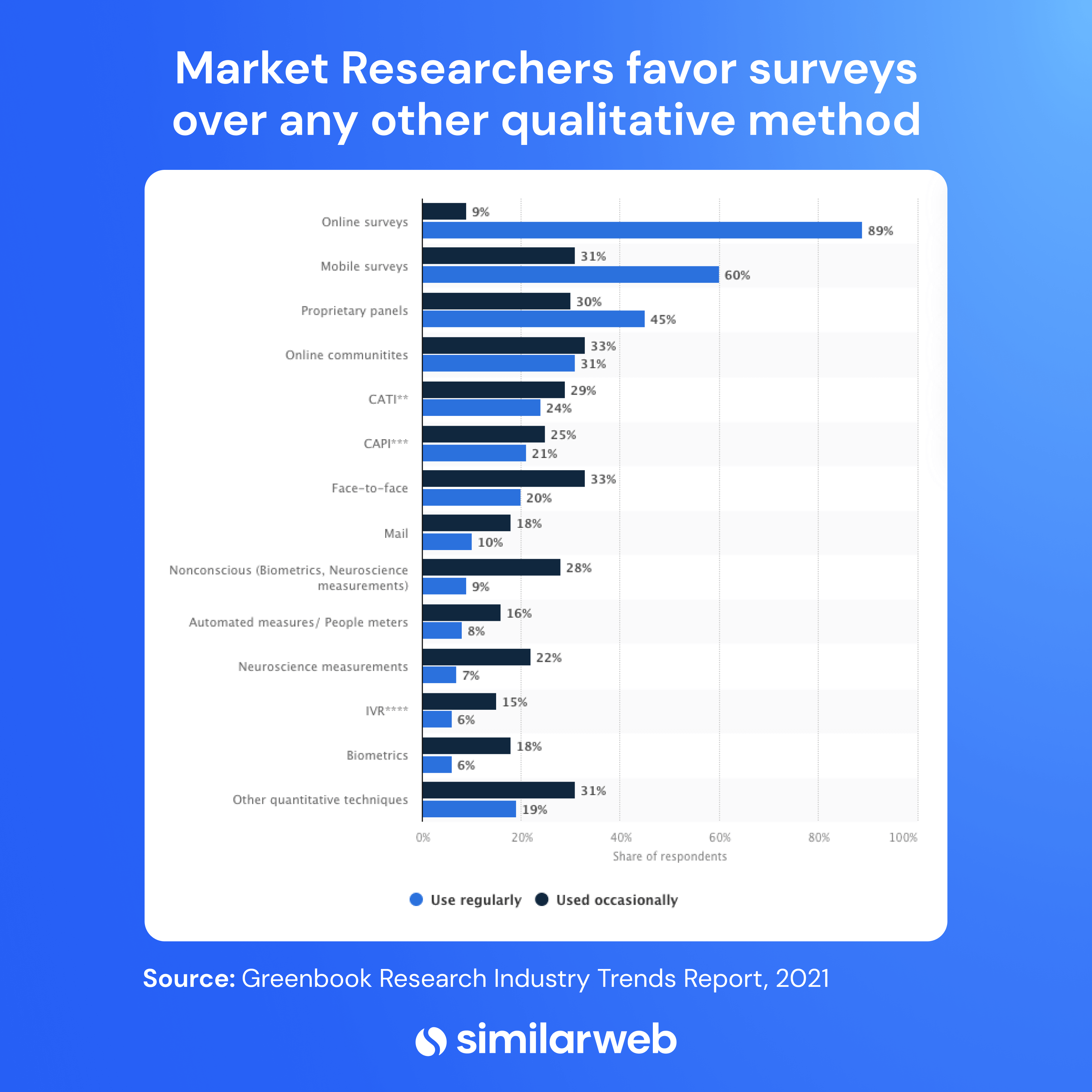

market research survey for new business

Business growth

Marketing tips

How to conduct your own market research survey (with example)

After watching a few of those sketches, you can imagine why real-life focus groups tend to be pretty small. Even without any over-the-top personalities involved, it's easy for these groups to go off the rails.

So what happens when you want to collect market research at a larger scale? That's where the market research survey comes in. Market surveys allow you to get just as much valuable information as an in-person interview, without the burden of herding hundreds of rowdy Eagles fans through a product test.

Table of contents:

- What is a market research survey?

Why conduct market research, primary vs. secondary market research.

6 types of market research surveys

How to write and conduct a market research survey

Tips for running a market research survey.

Market research survey campaign example questions

Market research survey template

Use automation to put survey results into action

A market research survey is a questionnaire designed to collect key information about a company's target market and audience that will help guide business decisions about products and services, branding angles, and advertising campaigns.

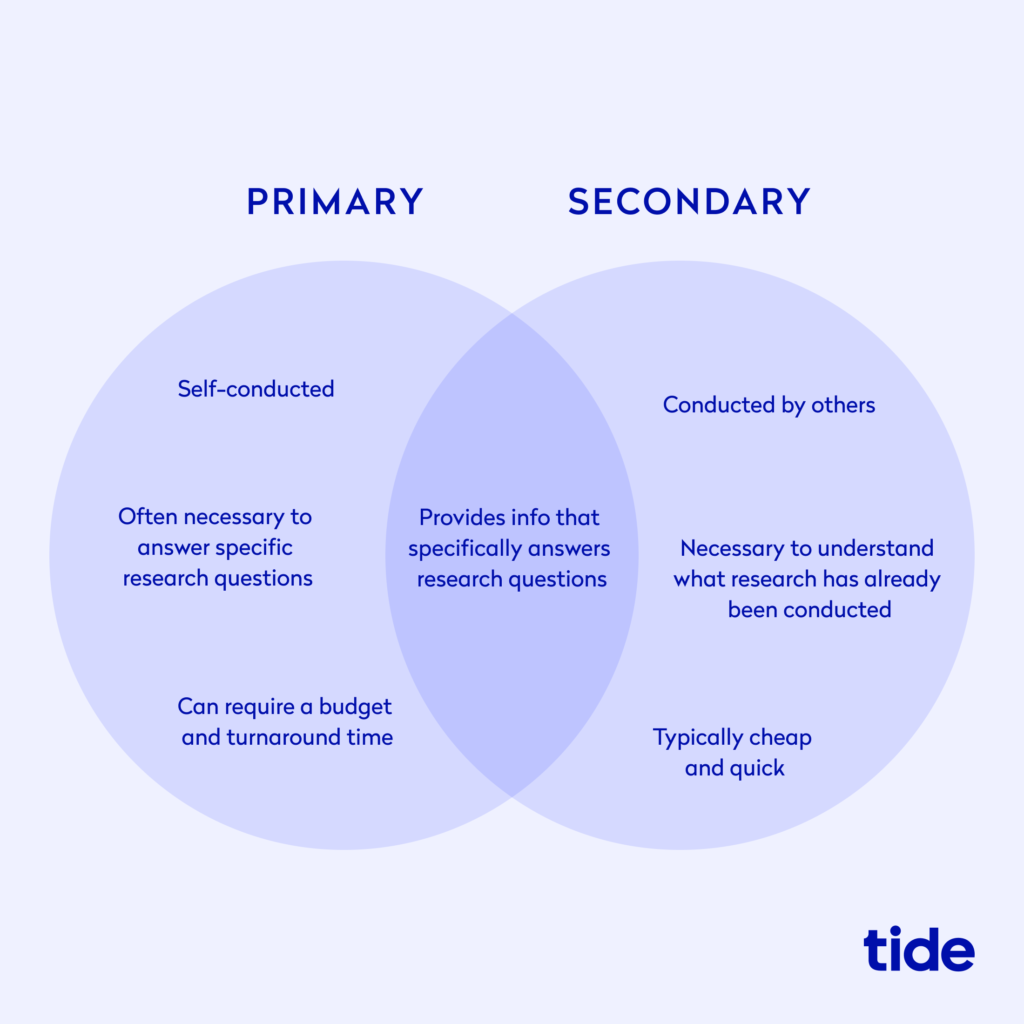

Market surveys are what's known as "primary research"—that is, information that the researching company gathers firsthand. Secondary research consists of data that another organization gathered and published, which other researchers can then use for their own reports. Primary research is more expensive and time-intensive than secondary research, which is why you should only use market research surveys to obtain information that you can't get anywhere else.

A market research survey can collect information on your target customers':

- Experiences

Preferences, desires, and needs

Values and motivations

The types of information that can usually be found in a secondary source, and therefore aren't good candidates for a market survey, include your target customers':

Demographic data

Consumer spending data

Household size

Lots of this secondary information can be found in a public database like those maintained by the Census Bureau and Bureau of Labor Statistics . There are also a few free market research tools that you can use to access more detailed data, like Think with Google , Data USA , and Statista . Or, if you're looking to learn about your existing customer base, you can also use a CRM to automatically record key information about your customers each time they make a purchase.

If you've exhausted your secondary research options and still have unanswered questions, it's time to start thinking about conducting a market research survey.

The first thing to figure out is what you're trying to learn, and from whom. Are you beta testing a new product or feature with existing users? Or are you looking to identify new customer personas for your marketers to target? There are a number of different ways to use a marketing research survey, and your choice will impact how you set up the questionnaire.

Here are some examples of how market research surveys can be used to fill a wide range of knowledge gaps for companies:

A B2B software company asks real users in its industry about Kanban board usage to help prioritize their project view change rollout.

A B2C software company asks its target demographic about their mobile browsing habits to help them find features to incorporate into their forthcoming mobile app.

A printing company asks its target demographic about fabric preferences to gauge interest in a premium material option for their apparel lines.

A wholesale food vendor surveys regional restaurant owners to find ideas for seasonal products to offer.

Market surveys are what's known as "primary research"—that is, information that the researching company gathers firsthand. Secondary research consists of data that another organization gathered and published, which other researchers can then use for their own reports.

Primary research is more expensive and time-intensive than secondary research, which is why you should only use market research surveys to obtain information that you can't get anywhere else.

Lots of this secondary information can be found in a public database like those maintained by the Census Bureau and Bureau of Labor Statistics . There are also a few free market research tools that you can use to access more detailed data, like Think with Google , Data USA , and Statista .

Or, if you're looking to learn about your existing customer base, you can also use a CRM to automatically record key information about your customers each time they make a purchase.

6 types of market research survey

Depending on your goal, you'll need different types of market research. Here are six types of market research surveys.

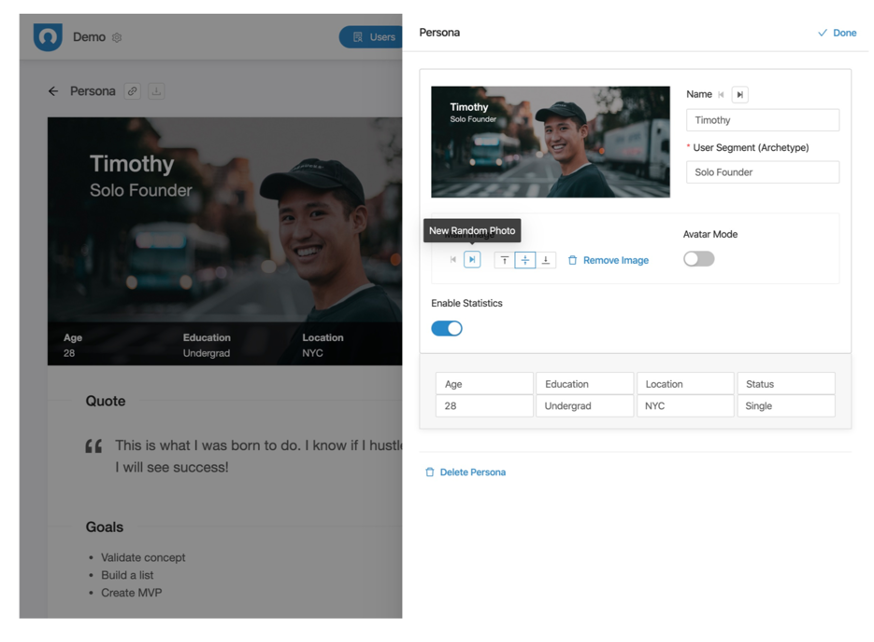

1. Buyer persona research

A buyer persona or customer profile is a simple sketch of the types of people that you should be targeting as potential customers.

A buyer persona research survey will help you learn more about things like demographics, household makeup, income and education levels, and lifestyle markers. The more you learn about your existing customers, the more specific you can get in targeting potential customers. You may find that there are more buyer personas within your user base than the ones that you've been targeting.

2. Sales funnel research

The sales funnel is the path that potential customers take to eventually become buyers. It starts with the target's awareness of your product, then moves through stages of increasing interest until they ultimately make a purchase.

With a sales funnel research survey, you can learn about potential customers' main drivers at different stages of the sales funnel. You can also get feedback on how effective different sales strategies are. Use this survey to find out:

How close potential buyers are to making a purchase

What tools and experiences have been most effective in moving prospective customers closer to conversion

What types of lead magnets are most attractive to your target audience

3. Customer loyalty research

Whenever you take a customer experience survey after you make a purchase, you'll usually see a few questions about whether you would recommend the company or a particular product to a friend. After you've identified your biggest brand advocates , you can look for persona patterns to determine what other customers are most likely to be similarly enthusiastic about your products. Use these surveys to learn:

The demographics of your most loyal customers

What tools are most effective in turning customers into advocates

What you can do to encourage more brand loyalty

4. Branding and marketing research

The Charmin focus group featured in that SNL sketch is an example of branding and marketing research, in which a company looks for feedback on a particular advertising angle to get a sense of whether it will be effective before the company spends money on running the ad at scale. Use this type of survey to find out:

Whether a new advertising angle will do well with existing customers

Whether a campaign will do well with a new customer segment you haven't targeted yet

What types of campaign angles do well with a particular demographic

5. New products or features research

Whereas the Charmin sketch features a marketing focus group, this one features new product research for a variety of new Hidden Valley Ranch flavors. Though you can't get hands-on feedback on new products when you're conducting a survey instead of an in-person meeting, you can survey your customers to find out:

What features they wish your product currently had

What other similar or related products they shop for

What they think of a particular product or feature idea

Running a survey before investing resources into developing a new offering will save you and the company a lot of time, money, and energy.

6. Competitor research

You can get a lot of information about your own customers and users via automatic data collection , but your competitors' customer base may not be made up of the same buyer personas that yours is. Survey your competitors' users to find out:

Your competitors ' customers' demographics, habits, and behaviors

Whether your competitors have found success with a buyer persona you're not targeting

Information about buyers for a product that's similar to one you're thinking about launching

Feedback on what features your competitors' customers wish their version of a product had

Once you've narrowed down your survey's objectives, you can move forward with designing and running your survey.

Step 1: Write your survey questions

A poorly worded survey, or a survey that uses the wrong question format, can render all of your data moot. If you write a question that results in most respondents answering "none of the above," you haven't learned much.

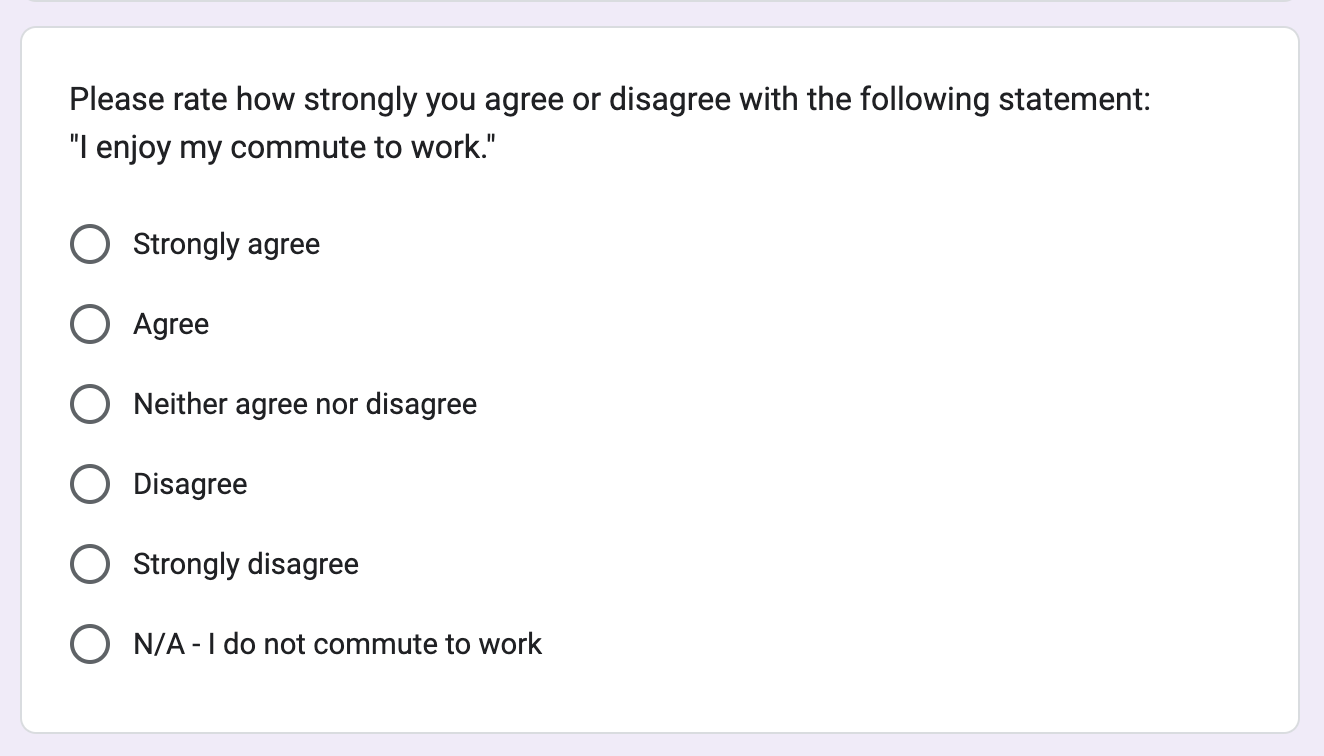

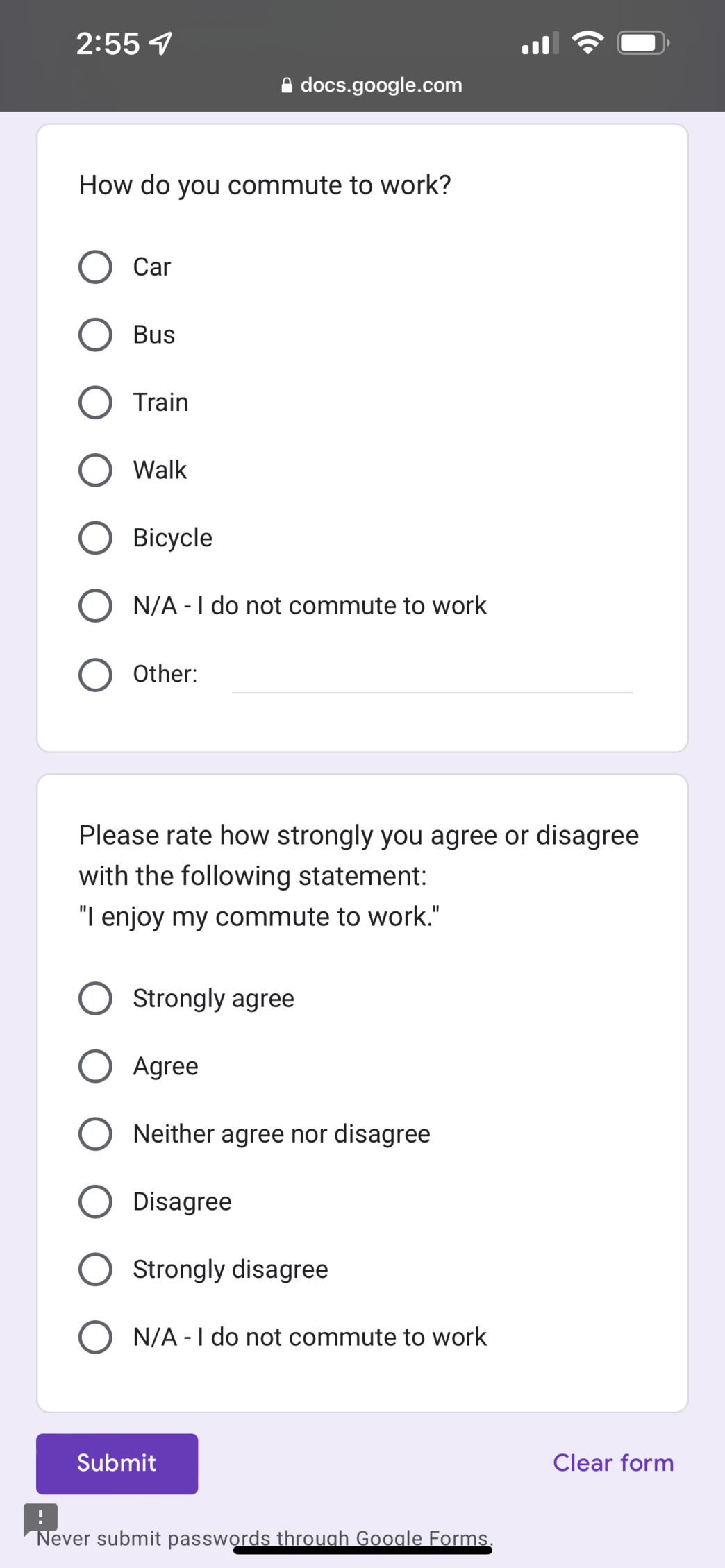

You'll find dozens of question types and even pre-written questions in most survey apps . Here are a few common question types that work well for market surveys.

Categorical questions

Also known as a nominal question, this question type provides numbers and percentages for easy visualization, like "35% said ABC." It works great for bar graphs and pie charts, but you can't take averages or test correlations with nominal-level data.

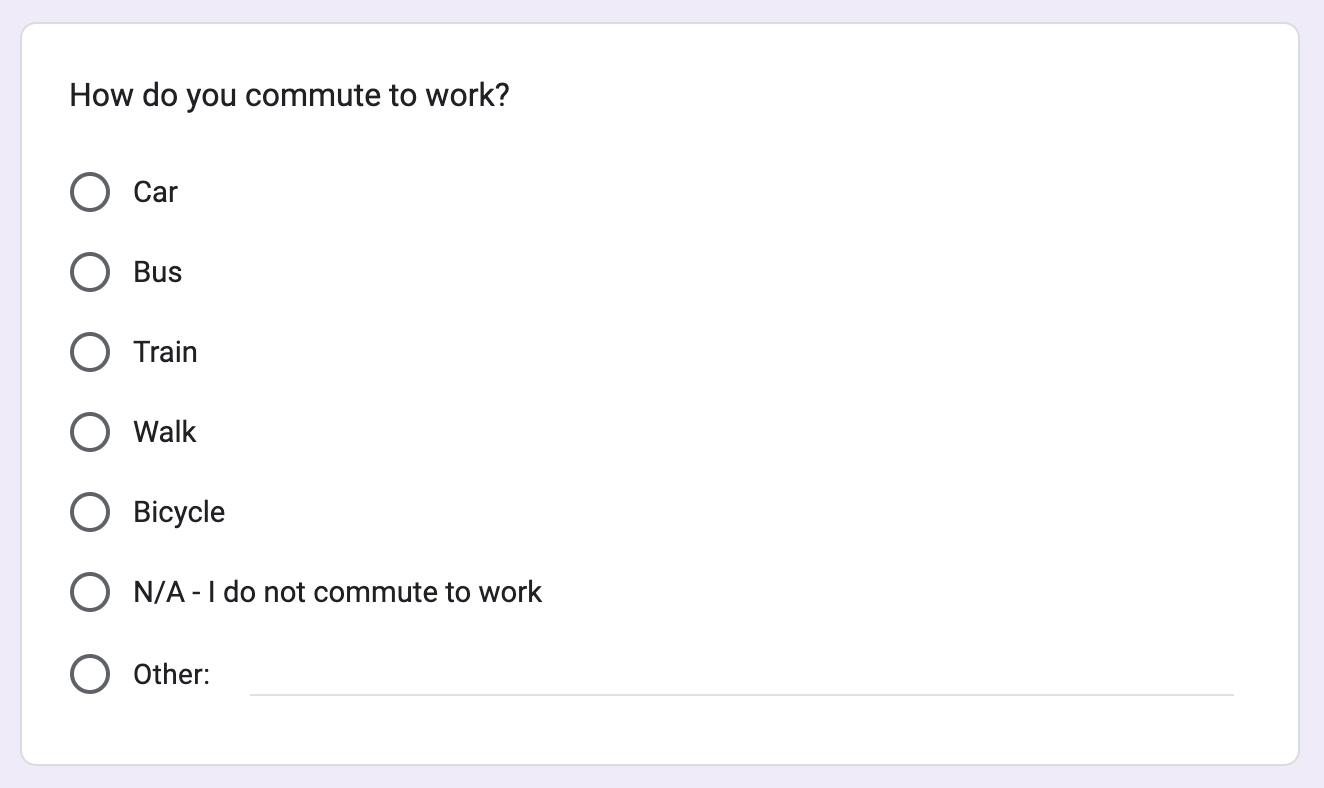

Yes/No: The most basic survey question used in polls is the Yes/No question, which can be easily created using your survey app or by adding Yes/No options to a multiple-choice question.

Multiple choice: Use this type of question if you need more nuance than a Yes/No answer gives. You can add as many answers as you want, and your respondents can pick only one answer to the question.

Checkbox: Checkbox questions add the flexibility to select all the answers that apply. Add as many answers as you want, and respondents aren't limited to just one.

Ordinal questions

This type of question requires survey-takers to pick from options presented in a specific order, like "income of $0-$25K, $26K-$40K, $41K+." Like nominal questions, ordinal questions elicit responses that allow you to analyze counts and percentages, though you can't calculate averages or assess correlations with ordinal-level data.

Dropdown: Responses to ordinal questions can be presented as a dropdown, from which survey-takers can only make one selection. You could use this question type to gather demographic data, like the respondent's country or state of residence.

Ranking: This is a unique question type that allows respondents to arrange a list of answers in their preferred order, providing feedback on each option in the process.

Interval/ratio questions

For precise data and advanced analysis, use interval or ratio questions. These can help you calculate more advanced analytics, like averages, test correlations, and run regression models. Interval questions commonly use scales of 1-5 or 1-7, like "Strongly disagree" to "Strongly agree." Ratio questions have a true zero and often ask for numerical inputs (like "How many cups of coffee do you drink per day? ____").

Ranking scale: A ranking scale presents answer choices along an ordered value-based sequence, either using numbers, a like/love scale, a never/always scale, or some other ratio interval. It gives more insight into people's thoughts than a Yes/No question.

Matrix: Have a lot of interval questions to ask? You can put a number of questions in a list and use the same scale for all of them. It simplifies gathering data about a lot of similar items at once.

Example : How much do you like the following: oranges, apples, grapes? Hate/Dislike/Ok/Like/Love

Textbox: A textbox question is needed for collecting direct feedback or personal data like names. There will be a blank space where the respondent can enter their answer to your question on their own.

Step 2: Choose a survey platform

There are a lot of survey platforms to choose from, and they all offer different and unique features. Check out Zapier's list of the best online survey apps to help you decide.

Most survey apps today look great on mobile, but be sure to preview your survey on your phone and computer, at least, to make sure it'll look good for all of your users.

If you have the budget, you can also purchase survey services from a larger research agency.

Step 3: Run a test survey

Before you run your full survey, conduct a smaller test on 5%-10% of your target respondent pool size. This will allow you to work out any confusing wording or questions that result in unhelpful responses without spending the full cost of the survey. Look out for:

Survey rejection from the platform for prohibited topics

Joke or nonsense textbox answers that indicate the respondent didn't answer the survey in earnest

Multiple choice questions with an outsized percentage of "none of the above" or "N/A" responses

Step 4: Launch your survey

If your test survey comes back looking good, you're ready to launch the full thing! Make sure that you leave ample time for the survey to run—you'd be surprised at how long it takes to get a few thousand respondents.

Even if you've run similar surveys in the past, leave more time than you need. Some surveys take longer than others for no clear reason, and you also want to build in time to conduct a comprehensive data analysis.

Step 5: Organize and interpret the data

Unless you're a trained data analyst, you should avoid crunching all but the simplest survey data by hand. Most survey platforms include some form of reporting dashboard that will handle things like population weighting for you, but you can also connect your survey platform to other apps that make it easy to keep track of your results and turn them into actionable insights.

You know the basics of how to conduct a market research survey, but here are some tips to enhance the quality of your data and the reliability of your findings.

Find the right audience: You could have meticulously crafted survey questions, but if you don't target the appropriate demographic or customer segment, it doesn't really matter. You need to collect responses from the people you're trying to understand. Targeted audiences you can send surveys to include your existing customers, current social media followers, newsletter subscribers, attendees at relevant industry events, and community members from online forums, discussion boards, or other online communities that cater to your target audience.

Take advantage of existing resources: No need to reinvent the wheel. You may be able to use common templates and online survey platforms like SurveyMonkey for both survey creation and distribution. You can also use AI tools to create better surveys. For example, generative AI tools like ChatGPT can help you generate questions, while analytical AI tools can scan survey responses to help sort, tag, and report on them. Some survey apps have AI built into them already too.

Focus questions on a desired data type: As you conceptualize your survey, consider whether a qualitative or quantitative approach will better suit your research goals. Qualitative methods are best for exploring in-depth insights and underlying motivations, while quantitative methods are better for obtaining statistical data and measurable trends. For an outcome like "optimize our ice cream shop's menu offerings," you may want to find out which flavors of ice cream are most popular with teens. This would require a quantitative approach, for which you would use categorical questions that can help you rank potential flavors numerically.

Establish a timeline: Set a realistic timeline for your survey, from creation to distribution to data collection and analysis. You'll want to balance having your survey out long enough to generate a significant amount of responses but not so long that it loses relevance. That length can vary widely based on factors like type of survey, number of questions, audience size, time sensitivity, question format, and question length.