Sailboat Insurance: The Best Options By Far

Last Updated by

Daniel Wade

January 26, 2024

Whether you own a yacht, speedboat, or fishing boat, it certainly didn't come cheap. So it's crucial to find the best sailboat insurance that will come to your rescue if something does happen.

Just like your home or car, your boat is probably one of your most prized assets and needs the right insurance as well. Even though boats are widely known for providing their owners with great recreation and adventure, they come with various types of risks. Whether it's an accident, fire, theft, or damage, these are just some of the disasters that can come your way and that can come your way. And even if boat insurance is not a must in your state or area, having your boat properly insured will keep your head above the water and prevent you from sinking. You, therefore, should understand how to protect your sailboat, yourself, and your passengers.

Boat insurance is essential in covering you in case of a loss of damage to your sailboat. It generally covers most types of watercraft including yachts, speedboats, pontoon boats, fishing boats, leisure crafts, paddle boats, and many more. Boat insurance will cover you from various things including collision damage, bodily injury liability, property damage liability, comprehensive coverage, and other additional coverage options.

The fact that sailboat insurance is widely available can make it quite overwhelming when looking for the right boat insurance for you. But to make it a lot easier for you, we've dug deep into the boat insurance industry and highlight the best sailboat insurance options to go for.

Table of contents

How to Find the Best Sailboat Insurance Coverage for You

There are a few things to consider when looking for the best boat insurance coverage for you.

What Does the Boat Insurance Cover?

It's of great importance to know what will be covered by your preferred boat insurance company before taking your boat out on the water. Needless to say, insurance policies and contracts are always very complex, so taking your time and understanding everything is essential. To give you a head start, here are a few things that your boat insurance should cover.

- Damage to the boat or permanently attached equipment such as anchors

- Damage arising from fire, theft, vandalism, collision, and lightning

- Property damage liability, which is essentially the damage that your boat causes to someone else's property

- Bodily injury liability, which revolves around the expenses incurred when someone gets injured on your boat or by your boat

- Medical payments for expenses incurred by you and your passengers in the event of an accident

- Guest passenger liability, which revolves around the legal expenses incurred when something happens if another person was using the boat with your permission

- Mechanical Breakdown coverage, which pays for the repair of any part of the boat as long as it's not caused by wear and tear

Some of the things that are not included in the insurance include:

- Normal wear and tear

- Damage caused by sharks or other creatures

- Defective machinery

- Damage caused by mold and insects

Types of Boat Insurance Policy

It's essential to know the type of boat insurance policy that you want. The two common options include:

Agreed Value - This is the amount that is agreed between you as the boat owner and the insurance company. This boat insurance tends to be more expensive since your boat's depreciation isn't taken into consideration. So in case of an accident, the insurer can even end up paying more than the current value of the boat.

Actual Cash Value - This revolves around the insurer paying up to the current actual value of the boat if anything happens. These premiums tend to be lower since the insurer will calculate the depreciation value and pay depending on the actual value of the boat.

Important Things to Know

Here are some important things to know as far as boat insurance is concerned.

- Navigational Limits - These are limits that outline where you can navigate your boat and you may not be covered if you venture beyond the agreed territory. Needless to say, your premiums will be higher if your navigation limits are extensive.

- Marine Inspection - Most insurers will require your boat to be inspected by a certified marine surveyor to assess the condition for the boat and its market value.

- Layup Periods - These refer to periods when you take your boat out of the water such as during winter when you're not boating. Most insurers will give you credit but you may not be covered if you take the boat out for a ride during the layup periods and something happens.

- Underage Operators - Do not be tempted to offer your boat to an underage if he/she doesn't meet the age and license requirements in your area.

Best Sailboat Insurance Companies

Progressive.

As one of the leaders in the insurance industry, Progressive has been providing boat insurance for over 35 years. This company has insured over 1 million boats and has a network of independent agents across the country who are always willing to guide you through their policies.

Although Progressive is widely known for providing auto insurance, its boat insurance offerings revolve around covering small to medium-sized boats measuring not more than 50 feet in length with value not exceeding $500,000. Some of the coverage options to expect from this company include collision coverage, comprehensive coverage, bodily injury and property damage liability, medical payments, mechanical breakdown coverage, and many more.

Unlike most boat insurance companies, Progressive doesn't require boaters to provide a navigation plan. As long as your seafaring adventures are within 75 miles of the U.S. or Canadian coastlines, Progressive will offer a solid and reliable plan for your boat insurance. The company's customizable boat insurance is a cherry on the cake as it makes it a lot easier for boaters to bundle their policies and work within their budgets.

Allstate - Best for Budget

Consistently ranked among the best by various rating institutions in terms of financial strength and customer service, Allstate is one of the biggest providers of boat insurance in the country. With boat coverage options as low as $21 monthly, Allstate offers some of the most affordable coverage options in the boat insurance industry.

The company offers many types of boat insurance and pledge to keep their customers in good and safe hands. From your repair costs, trailer coverage, watercraft liability coverage to uninsured watercraft coverage, and many more, the average cost of boat insurance from Allstate is just about $20 a month.

Nationwide - Best Option for Bundling

Offering unique options for each boater's unique boating lifestyle, Nationwide is widely known for offering the best multi-policy options in the boat insurance industry. In other words, it can give you some of the best coverage options for your boat if you decide to combine your home, car, and boat insurance. With this, you'll get amazing extra perks such as rental reimbursement coverage, optional towing, and road assistance if your boat trailer is included in the coverage.

This is a company that will offer you amazing deals and discounts of up to 25% if you choose to bundle your boat insurance with at least one other policy provided by the company. What's more; they offer affordable packages for fishing equipment ($1,000), personal effects ($3,000), and towing ($500).

United States Power Squadron (USPS) Boat Insurance Program - Best for USPS Members

USPS is one of the few boat insurance companies that strictly offer insurance for boats. This may be quite disadvantageous for those looking for bundling options but it's great if you're looking for a company that puts its total focus on ensuring your safety and that of your vessel while out there on the water.

As such, this company offers automatic coverage for water skiing, hurricane safe harbor reimbursements, and personal effects coverage of up to $1,500. It also offers automatic fuel spill liability not exceeding $854,000. This is a company that offers among the most competitive packages for serious boaters out there. They offer online quotes, same-day coverage, and policy discounts if you pay premiums in bulk as well as round the clock claims processing.

Markel - Best for Anglers

If you're an angler looking for the best boat insurance for your vessel and fishing equipment, as well as other personal effects, look no further than Markel. With its professional fisherman policy, this company offers replacement cost coverage of up to $5,000 for fishing equipment and cost coverage of up to $10,000 for personal effects.

The company also offers discounts for operators aged 40 and above, accident-free discounts, and discounts for anglers or boaters with more than five years of experience. The best part is that you can save up to 35% on your boat insurance premium if you qualify for these discounts.

So whether you're a professional angler or just fishing for fun, Markel offers some of the best boat insurance coverage options for anglers. You'll be in safe hands with just $100 per year but this may depend on the coverage options that you need.

BoatUS - Best for Additional Benefits

Acquired by Geico in 2015, BoatUS has been offering boat insurance through its affiliation with the Boat Owners Association of the United States. It offers all types of coverage options including actual cash value coverage, liability-only coverage, and full coverage at an agreed value.

The best part for considering BoatUS for your boat insurance is that the company has some of the best additional benefits in the boat insurance industry. For example, all policies must include fuel spill liability coverage and supplemental medical coverage. This, therefore, means that the total costs of your insurance premiums will be reduced significantly thanks to these deductibles and additional benefits. You can also get discounts for good driving records and the completion of approved safety courses. For members, there are even more additional benefits.

State Farm - Best for Emergency Services Coverage

As one of the best-known names in the insurance industry in the country, State Farm might be your go-to-guys if you're looking for the best emergency services coverage. The company offers optional emergency services for up to $500 to service your boat, boat trailer, or motor in case of any damage as stipulated in your coverage contract. The company's optional wreck-removal coverage can also be ideal for you if you're looking for reasonable expenses if you're required by law to raise or remove your boat or wreckage.

The company also provides multi-policy discounts, which can be ideal for you if you want to cut down paperwork and combine your home, auto, and boat insurance. So whether you're a proud owner of a yacht or a modest kayak, State Farm can provide coverage options for your unique needs, especially in times of emergency.

Foremost - Best for Flexible Coverage Options

Known for offering affordable boat insurance coverage options across the country, Foremost can be a great option for you if you're looking for a boat insurance company that can offer coverage options that are suited for your unique insurance needs. Some of its unique coverage options include enhanced towing services, hurricane haul-out, additional pollution liability coverage, fishing tournament fee reimbursement, trip interruption service, pet coverage, and many more.

Most of these coverage options are flexibly tailored to lower your premiums and make boat insurance quite affordable. This company is widely known for insuring specialty risks and can easily offer good, better, and best coverage packages depending on how much you're willing to pay and the types of coverage options that you want.

Hagerty - Best for Classic Boats

Just like classic cars, we all know that classic boats are a rarity and you certainly want the best insurer for your unique an exotic classic boat. Of course, owners of classic boats have special needs that might not be the same as other boats, and this requires a company that offers these specialties. Well, Hagerty takes immense pride as one of the best boat insurers for classic boats.

The company not only offers personalized insurance services but also utilizes actual cash value to determine the right coverage limits for your boats. Its agents are also affiliated with well-known boating clubs whose members are generally proud owners of classic boats. So you can consider joining one of these boating clubs and you might be in for significant discounts on your insurance premiums for your classic boat.

United Marine Underwriters - Best for Personalized Customer Service

Having provided boat insurance across the United States except in New Mexico for nearly three decades, United Marine Underwriters takes immense pride in presenting itself as a specialty boat insurance company that puts a lot of emphasis on customer service, happiness, and safety.

This company offers liability limits of up to $1 million and you get various discounts if you meet certain thresholds. For example, you'll get substantial discounts if you complete one of the recognized boat safety courses that are approved by the National Association of State Boating Law Administrators and the Coast Guard Auxiliary and Power Squadron. The company also assigns you a primary service person to take care of all your servicing needs, which is why it's widely known for its excellent customer service.

Legally speaking boat insurance is not a must in many states unless you come you're planning to boat in Utah, Hawaii, and Arkansas. However, the peace of mind that boat insurance gives you when out on the water can never be underestimated. And because your boat is probably one of your most prized possessions, it's essential to choose the best sailboat insurance option; something that covers all your needs.

Related Articles

I've personally had thousands of questions about sailing and sailboats over the years. As I learn and experience sailing, and the community, I share the answers that work and make sense to me, here on Life of Sailing.

by this author

Financial and Budgeting

Most Recent

What Does "Sailing By The Lee" Mean?

October 3, 2023

The Best Sailing Schools And Programs: Reviews & Ratings

September 26, 2023

Important Legal Info

Lifeofsailing.com is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon. This site also participates in other affiliate programs and is compensated for referring traffic and business to these companies.

Similar Posts

Best Bluewater Sailboats Under $50K

December 28, 2023

How To Choose The Right Sailing Instructor

August 16, 2023

Cost To Dock A Sailboat

May 17, 2023

Popular Posts

Best Liveaboard Catamaran Sailboats

Can a Novice Sail Around the World?

Elizabeth O'Malley

June 15, 2022

4 Best Electric Outboard Motors

How Long Did It Take The Vikings To Sail To England?

10 Best Sailboat Brands (And Why)

December 20, 2023

7 Best Places To Liveaboard A Sailboat

Get the best sailing content.

Top Rated Posts

Lifeofsailing.com is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon. This site also participates in other affiliate programs and is compensated for referring traffic and business to these companies. (866) 342-SAIL

© 2024 Life of Sailing Email: [email protected] Address: 11816 Inwood Rd #3024 Dallas, TX 75244 Disclaimer Privacy Policy

You are about to leave geico.com

When you click "Continue" you will be taken to a site owned by , not GEICO. GEICO has no control over their privacy practices and assumes no responsibility in connection with your use of their website. Any information that you provide directly to them is subject to the privacy policy posted on their website.

Boat Insurance

Get your customized boat insurance quote today..

Or continue previous quote .

Manage Your Boat Insurance Policy

GEICO Marine (formerly Seaworthy) Policyholders

- Log in to GEICO Marine to manage your policy or call (877) 581-BOAT (2628)

- Mon - Fri 8:00 am - 10:00 pm, Sat - Sun 8:00 am - 9:15 pm

SkiSafe Policyholders

- Log in to SkiSafe to your policy or call (800) 225-6560

- Mon - Thu 9:00 am - 7:00 pm, Fri 9:00 am - 6:00 pm, Sat 9:30 am - 5:30 pm

Or call us at (800) 841-3005

Need a boat insurance quote?

Existing boat policyholder?

Get a boat insurance policy to protect your investment.

Boat insurance is crucial for protecting your investment, whether you're navigating lakes, rivers, or ocean waters across the United States. With GEICO for your boat and BoatUS–the nation's largest group of recreational boat owners–you're backed by a partnership with over 50 years of experience in making boating safer and more enjoyable.

Whether you're looking to start a new policy or find savings on an existing one, we're here to make boating better. Get started with a free boat insurance quote today and benefit from competitive rates without compromising on service. Protect your peace of mind and enjoy the waters with confidence, knowing that you have reliable coverage from names you can trust.

Why do you need boat insurance?

A boat insurance policy helps protect you and your boat. If you don't have a separate boat insurance policy, you're probably underinsured. This could mean paying a lot out of pocket for accidents outside your control. Many homeowners policies cover minor boating risks but don't cover your needs sufficiently due to:

- Size restrictions

- Limitations on horsepower

- Limits on damage coverage

Boat insurance can provide coverage for:

- Damage to your boat including hull, sails, equipment, and more.

- Fuel spill liability

- Liability to pay for damages and injuries you cause if you hit another boat, person, or dock

- Medical coverage for you and persons in your boat.

- Wreckage removal

Check out our "boating insurance explained" video for more reasons why boat insurance is a smart idea.

What types of watercrafts are covered by boat insurance?

All boats aren't the same. You need to customize your boat insurance to meet your needs and provide your watercraft with the proper coverage. Here is a list of the most common types of watercrafts.

- Pontoon boats are one of the most popular inland water boats. They are a flattish boat that rely on floats to remain buoyant. Their wide and spacious area is great for many passengers to enjoy the ride.

- Personal watercraft (PWC) are powered by a water jet pump and the rider generally sits, stands, or kneels on it. There are many types of PWCs which include WaveRunners, Sea-Doos and more.

- Fishing and bass boats are designed and equipped for fishing. Most are powered by an outboard motor and are equipped with power poles, trolling motors, etc.

- Powerboats are the most popular type of boat used for cruising, watersports, and so much more.

- Sailboats are propelled partly or entirely by sails.

If you don't see your watercraft listed and are looking for more information on different types of boats and insurance for boats, check out our boat FAQ page .

What does boat insurance cover?

Understanding the different types of boat insurance coverage is crucial for ensuring your watercraft and your finances are protected against on-water incidents. At GEICO, we offer a variety of coverage options to suit every boater's needs, including:

Liability Coverage

Essential for all boat owners, liability insurance covers damages and injuries to others if you're at fault in an accident. This includes costs associated with injuries, property damage, and legal fees.

Hull and Equipment Coverage

Hull and Equipment Coverage protects your boat if it collides with another vessel or object. It also covers non-collision-related damages to your boat, such as those from fire, theft, or storms.

24/7 Boat Towing*

Boat towing coverage assists with towing costs and provides emergency services if your boat breaks down or you get stranded, so you can have peace of mind on the water.

Each type of coverage provides specific protections, allowing you to customize your policy according to your boating lifestyle and the risks you might encounter. Whether you're a casual weekend sailor or a dedicated marine enthusiast, understanding and selecting the right boat insurance coverages can make all the difference. Choose the boat insurance coverage that best fits your needs and sail with confidence knowing that GEICO has you covered.

How much does boat insurance cost?

Boat insurance is based on the type of boat, length, number of engines and horsepower, how you use it (recreation, charter, racing, etc.), and how and where it will be stored. All of these factors, including the experience and claims record of the owner/primary operator will factor into the cost of boat insurance.

Boost Your Savings With our Boat Insurance Discounts

GEICO offers several boat insurance discounts to help make coverage more affordable for boat owners. Some discounts include:

Multi-Policy Discounts

Save on boat insurance by bundling it with your GEICO Auto or additional GEICO Marine policy.

Boat Safety Courses

Discounts are available for boaters who have completed an approved boating safety course such as State Certified Safety , American Sailing Association Course , U.S. Power Squadrons , Charter Boat Captain's License, and U.S. Coast Guard Auxiliary .

Full-Pay Discount

Paying your policy in full upfront instead of in installments can lead to savings.

It's always a good idea to speak directly with a GEICO representative for the most current information regarding discounts and how you might be able to apply them to your policy.

Secure Your Boat Insurance Today

Don't wait until it's too late to think about protecting your boat. At GEICO, we offer tailored boat insurance policies designed to meet the unique needs of every boater.

Take action now! Get a free, no-obligation quote today, or speak directly with one of our specialists. They're available to answer your questions and guide you through your policy options, ensuring you have the perfect coverage for your boating lifestyle.

Call Us: (855) 395-1412

- Mon - Fri 8:00 AM - 10:00 PM (ET)

- Sat - Sun 8:00 AM - 9:15 PM (ET)

Boat Insurance FAQ

- Is boat insurance required? Boat insurance liability coverage is only mandated in a few states, so always check insurance requirements for the state you're boating in. Physical damage coverage is required by your lender if you're financing your boat or watercraft. If you keep your boat at a marina, the marina may require you to have liability coverage.

- Liability to pay for damages and injuries you cause if you accidentally hit another boat, person, or dock

There are some types of watercrafts that are not eligible for a GEICO boat policy including but not limited to:

- Airboats, amphibious land boats or hovercraft

- Boat with more than 4 owners

- Boats over 50 feet in length

- Boats over 40 years old

- Boats valued over $2,500,000

- Floating homes

- Homemade boats

- Houseboats that do not have motors

- Steel hulls

- Wooden hulls

- Watercraft previously deemed a constructive total loss

- Does boat insurance cover theft? Our Agreed Hull Value, and Actual Cash Value policies protect against damage to your watercraft from incidents out of your control, including theft.

- How do I make a payment or manage my boat insurance policy? Managing your boat insurance policy and making payments is easy in the BoatUS app. You can also manage your policy or make payments online , or by calling (800) 283-2883 .

- How do I report a claim on my boat insurance policy? You can report your claim through the BoatUS app. Claims can also be reported online , or by calling (800) 937-1937 .

GEICO has teamed up with its subsidiary, BoatUS, to bring boaters a policy developed by specialists, with the great service you expect from GEICO. Policies are underwritten by GEICO Marine Insurance Company. BoatUS—Boat Owner's Association of The United States—is the nation's largest association for recreational boaters providing service, savings and representation for over 50 years.

The above is meant as general information and as general policy descriptions to help you understand the different types of coverages. These descriptions do not refer to any specific contract of insurance and they do not modify any definitions, exclusions or any other provision expressly stated in any contracts of insurance. We encourage you to speak to your insurance representative and to read your policy contract to fully understand your coverages. Some discounts, coverages, payment plans, and features are not available for all customers, in all states, or in all locations.

*Boat and PWC coverages are underwritten by GEICO Marine Insurance Company. The TowBoatU.S. Towing Coverage Endorsement is offered by GEICO Marine Insurance Company, with towing services provided by the BoatU.S. Towing Program. Towing coverage only applies to the insured watercraft.

Colorado Language Preference

Are you a resident of or looking for insurance in the State of Colorado?

We are temporarily unable to provide services in Spanish for Colorado residents. You will now be directed to an English experience.

Estamos encantados de ofrecer nuestra nueva version del sitio web en Español. Apreciamos su paciencia mientras seguimos mejorando su experiencia.

Boat Insurance from Experts.

Boat insurance from experts.

Your online quote is just minutes away!

- Policies for All Boat Types - Yacht to PWC

- Coverage for Fishing and Watersports Gear

- Unlimited Towing from TowBoatUS

- 24/7 Claims Service from Boating Experts

- Multi-Policy Discounts - Bundle and Save!

BoatUS and GEICO have teamed up to bring boaters a great boat insurance policy at a great price.

- Agent Directory

- Company Directory

Find an Independent Agent

- Get Matched with an Agent

- Agent Directory by State

Find an Insurance Company

- Get Matched with a Company

- Company Directory by State

What type of insurance do you need?

- Business Insurance

- Home, Auto & Personal Insurance

- Life & Annuities

By Coverage Type

- Commercial Auto Insurance

- Professional Liability Insurance

- Small Business Insurance

- Business Umbrella Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Business Owners Policy

- Builders Risk Insurance

- Cyber Liability Insurance

- Surety Business Bonds

- Inland Marine Insurance

- Employers Liability Insurance

- Employment Practices Liability Insurance

- Environmental Liability Insurance

- Errors and Omissions Insurance

- Insurance Coverage & Advice by State

- See more ...

By Business Type

- Retail Store

- Agriculture & Forestry

- Construction

- Manufacturing

- Wholesale Trade

- Retail Trade

- Transportation & Warehousing

- Information Industry

- Finance & Insurance

- Real Estate

- Scientific & Technical Services

Auto & Vehicle Insurance

- Car Insurance

- Motorcycle Insurance

- Boat Insurance

- RV / Motorhome Insurance

- ATV Insurance

- Snowmobile Insurance

- Personal Watercraft Insurance

- Collectible Auto Insurance

- Umbrella Insurance

Home & Property Insurance

- Homeowners Insurance

- Condo Insurance

- Farm Insurance

- Landlord Insurance

- Renters Insurance

- Mobile Home Insurance

- Contents Insurance

- Vacant Land Insurance

- Flood Insurance

Other Insurance

- Life Insurance

- Long Term Care Insurance

- Disability Insurance

- Health Insurance

- Special Event Insurance

- Short-term / Sharing Insurance

Insurance Solutions & Resources

- Compare Car Insurance

- Compare Home Insurance

We'll Help You Find the Best Boat Insurance in Minutes

Our nationwide network of local independent agents is ready to help you find the perfect coverage at the best rate..

TrustedChoice.com Article

How will this quote help me?

Your quote is based on several common factors to give you a clear picture of the cost you can expect, though an independent agent can shop around and maybe even improve your rate!

NOTE: This quote is not final, though we did work with professional actuaries to help get you a ballpark figure to get started.

Do you have to have boat insurance on a boat?

Only two states require boat insurance by law, but there are a few instances where you may need it. If you dock your boat at a marina, they may require some form of coverage in order to protect their business. Also, if you finance your boat, nearly every lender will require coverage to protect their investment; use our list of the best boat insurance companies as a starting point.

Other than that, you should always have at least liability coverage on your boat to protect yourself against lawsuit costs if you cause bodily injury or property damage to another party. Property coverage is optional, but again, the more comprehensive your coverage, the better it can protect you.

How much is boat insurance?

The cost of any boat insurance policy depends on a number of factors, including your boat's size, value, and horsepower. Boat insurance policies can range from the low hundreds to tens of thousands of dollars annually, depending on what kind of coverage you need.

Do I need to insure my boat trailer?

Insuring your boat trailer is always a safe bet. Though your boat trailer may be protected by your home or car insurance policy, you can also add coverage to your boat insurance for your trailer. It's best to talk to your independent insurance agent about your boat, the trailer, and how you use it to determine the right coverage amount.

Does boat insurance cover passengers?

If your policy includes medical payments coverage, it will cover injuries to your passengers if you get into an accident. Medical payments coverage is an important option because just one accident can cause injuries that are extremely costly to treat.

Does boat insurance cover theft?

Typically, yes. But it's important to review your specific boat insurance policy with your independent insurance agent to make sure. Every carrier and every policy is different, but the more you know about your own policy, the better it will help protect you.

Does boat insurance cover hurricanes?

In most cases, yes, your boat will be covered against hurricane damage. But, as with any other natural disaster or unexpected event, you'll want to double-check your policy.

Does boat insurance cover engine damage?

No, boat insurance often excludes defective machinery or maintenance costs. Wear and tear is a natural outcome of use and not covered by your policy.

What is the cost difference in insuring different kinds of boats?

The size and value of your boat are two of the most impactful features on the cost of your coverage. Insurance for a $20,000 boat can cost an average of only $300 per year, while insuring a $2 million yacht can cost as much as $30,000 per year.

Does boat insurance cover me if I hit a rock?

If you have collision coverage on your boat insurance, you should be covered for the cost of repairs if you hit a rock.

Does boat insurance cover a blown engine?

In certain cases, boat insurance may cover a blown engine if the disaster was due to a listed peril. For example, ice and freeze damage to engines is typically covered. However, blown engines due to the owner's negligence are not covered.

BOAT INSURANCE

Find the perfect agent to shop multiple insurance companies on your behalf, saving you time and money.

Boat owners can experience a lot of joy and excitement brought by their watercraft, but they also have to anticipate potentially costly disasters ahead of time. Aside from accidents on the water, your boat is also vulnerable to theft, vandalism, flood damage, and more. That's what makes having boat insurance so critical.

An independent insurance agent can help protect your vessel with the right boat insurance long before you ever need to file a claim. But first, here's some boat insurance 101.

What Is Boat Insurance?

Boat insurance is designed to cover boat owners and their watercraft in case of many different disasters, including accidents, fire, and more. These policies are made to protect boats that have motors, like yachts, pontoon boats, etc., but they don't cover kayaks or canoes. Boat insurance is important because homeowners insurance doesn't provide enough coverage on its own for most watercraft.

Do You Have to Have Insurance on a Boat?

Only two states actually require boat insurance coverage , but there are a few situations where you may need it. First, if you dock your boat at a marina, they may require some form of coverage in order to protect their business. Second, if you financed your boat, nearly every lender will require coverage to protect their investment.

Further, there are certain types of boats that are more important to insure than others due to their value, risk level, and more. Here's a handy guide to whether you need boat insurance for your vessel.

| Boats that need insurance: | Boats that don't need insurance: |

|---|---|

| Boats that have 25 horsepower or greater | Boats with less than 25 horsepower |

| Yachts | Small engine boats |

| Large sailboats | Small sailboats |

| WaveRunners | Canoes |

| Jet boats | Inexpensive boats |

Most often, boat insurance is purchased for:

- Utility boats

- Fishing boats

- Pontoon boats

Despite all the fun to be had with a boat, accidents and disasters can happen. The easiest way to protect yourself and others, and get you back on the lake after a situation, is with the right boat insurance.

Best Boat Insurance Companies

While many carriers offer boat insurance, it's helpful to know some of the top names in the industry before you start shopping. Here are a few of our highest-recommended boat insurance companies.

| Top Boat Insurance Companies | Star Rating |

|---|---|

An independent insurance agent can help you get the right boat insurance policy for you from one of these top-rated carriers, or another that best meets your needs.

Do I Need Boat Insurance?

The only two states that require boat insurance by law are Utah and Arkansas. Boat owners in these states must have coverage for personal watercraft or for powerboats with 50 horsepower or greater. Otherwise, if you live elsewhere and your boat is designated for personal use, you're not technically required to have insurance for it.

However, if you lease or otherwise finance your boat, you're likely to be required by your lender to carry boat insurance, and often you'll need both collision and comprehensive coverage. When docking your boat, you're often also required by the marina to have liability coverage. However, with boating accidents being so common, it's important to at least consider getting boat insurance for yourself.

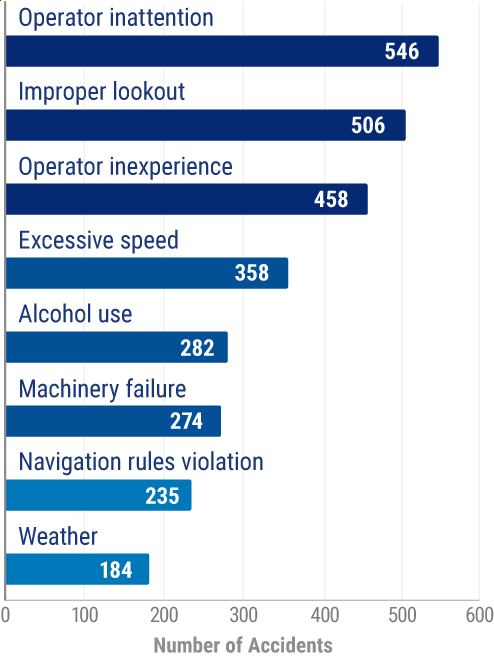

Most Common Types of Boating Accidents

Notice that the top five causes of boating accidents are due to human error, such as inattention, improper lookout, alcohol use, and inexperience. Since you can't often blame the boat for an accident or other disaster, it's even more critical to ensure that your vessel is covered with the right insurance.

How Much Is Boat Insurance?

The average annual cost of boat insurance ranges from $200 to $500 depending on the type of boat you have and other factors. It also depends on which types of coverage you need, and how much coverage you need. For folks who only purchase liability coverage, you might pay less than $100 annually.

Often, you can expect the annual cost of your boat insurance to be about 1.5% of the value of your boat. For example:

- $20,000 boats cost about $300 annually to insure

- $50,000 boats cost about $750 annually to insure

- $100,000 boats cost about $1,500 annually to insure

- $500,000 boats cost about $7,500 annually to insure

- $2 million boats, like yachts, cost about $30,000 annually to insure

- If you are looking for boat insurance for older boats , costs will vary significantly

The cost of your boat insurance might not be this simple to figure out, though. For more help calculating the cost of your premiums, use our boat insurance calculator or reach out to an independent insurance agent for a quote.

What Factors Influence Boat Insurance Costs?

Like any form of coverage, boat insurance costs depend on several factors, including:

The make, model, and value of your boat

Your boat's make, model, and value influence the cost of boat insurance because the more expensive your boat is to replace or repair, the more expensive your coverage must be. If your boat is valued at less than $20,000, you will pay approximately the average cost in your state. If your boat is valued above $500,000, you might pay up to 2,250% of the average cost in your state.

Your boat's length

Boat insurance costs also depend on the length of your boat. Be prepared to pay about 66% more for your coverage if your boat is 100 feet or longer, but if your boat is less than 20 feet, you may pay 12% less than average rates in your state.

Your boating records

If you've had six or more accidents or violations within the past five years, you can expect a 90% increase in your boat insurance premiums. However, if you've had no incidents during this time, you can expect a 40% decrease in your boat insurance premiums.

Your location

Boat insurance premiums vary considerably by the state you live in. Many factors can influence insurance costs by location, including crime rates, property values, and more.

How you use your boat

Depending on the risk level of the activities you perform with or on your boat, your premiums may be higher or lower. Using a boat for towing can be riskier than using it just for fishing, so boats used for fishing would be likely to have lower boat insurance premiums.

How often you use your boat

Similar to auto insurance, how often you use your boat can also influence your boat insurance rates, because the more you use it, the more likely an accident or other disaster is to occur. For boats that only get taken out on occasion, premiums for boat insurance can be much lower than those that get used daily on the water.

An independent insurance agent can provide you with quotes for boat insurance from several carriers near you.

What Discounts on Boat Insurance Exist?

Many insurance companies offer several discounts on boat insurance to help lower the cost of your premiums. Here are just a few common boat insurance discounts:

- Boater safety course discount: You might qualify for a discount on boat insurance if you complete a state-approved boater safety course.

- Bundling discount: Many insurance companies offer discounts if you bundle your boat insurance with another policy through them, such as auto insurance or home insurance.

- Paid-in-full discount: Many insurance companies lower your overall premium if you pay for your entire year's worth of coverage up-front.

- Homeowners discount: Some insurance companies even offer discounts on your boat insurance just for being a homeowner, even if your coverage is not through the same carrier.

- Clean boating history discount: You're likely to be rewarded with a boat insurance discount by many carriers if you've maintained a clean, accident and violation-free boating record.

Your independent insurance agent is a great ally in helping you find any discounts you may qualify for on boat insurance, no matter which carrier you go through.

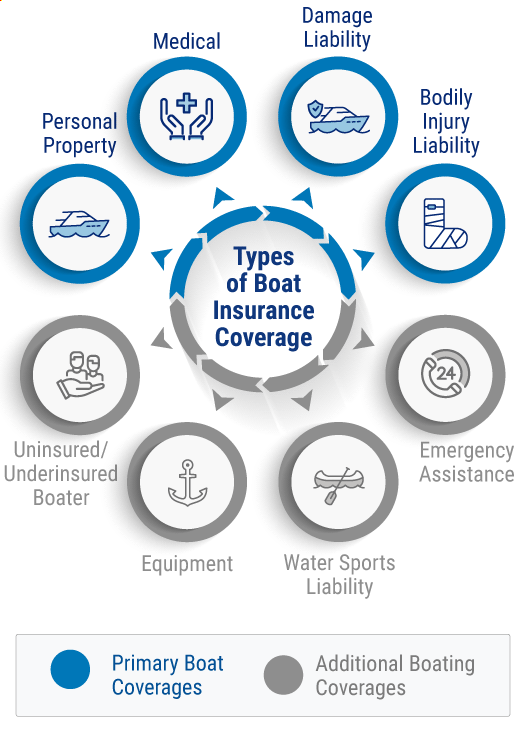

What Does Boat Insurance Cover?

Boat insurance provides a lot of important protection, not only for your boat, but also for you, your passengers, and everyone else on the water or at the marina. Boat insurance typically includes the following primary coverages:

- Personal property damage: Provides reimbursement for your boat, trailer, and engine if they're damaged by a covered peril like vandalism, fire, etc.

- Medical payments: Provides reimbursement for treatment of injuries to you and your passengers who get hurt by your boat or while on your boat.

- Property damage liability: Provides reimbursement of property damage lawsuit costs from third parties due to your boat.

- Bodily injury liability: Provides reimbursement for injuries to anyone who gets physically harmed by your boat.

The following coverages are commonly added to standard boat insurance:

- Uninsured/underinsured boaters: Covers injury expenses if the other boater is responsible but doesn’t have any, or enough, insurance to cover your expenses.

- Fishing equipment: Sometimes included, you'll be reimbursed up to a certain limit, like $1,000.

- Water sports liability: Some policies exclude water sports from your liability coverage and some don't, but this coverage is important if you'll be doing stunts, etc.

- Emergency assistance on the water: Also known as boat towing insurance, coverage provides water towing and other assistance services through a maritime dispatch center.

- Roadside assistance for your boat and trailer: This coverage guarantees that the towing company will take your vehicle, boat, and trailer to the nearest facility if you get stranded on the road.

If you have questions or concerns based on your plans on the water, it's best to talk to your independent insurance agent. They can help you find and increase coverage so that it works best for you.

Important Additional Coverages for Boats

Beyond the common coverages, it's always recommended to consider additional coverages that can help tailor the policy to your unique risks. Here are several optional boat insurance coverages worth considering:

- Collision: Provides coverage for collisions between your watercraft and other vessels or objects. You're also covered if your boat capsizes on the water.

- Comprehensive: Covers other disasters beyond collision like theft, vandalism, storm damage, and more.

- Hurricane hauling services: Covers the cost of moving your watercraft out of the county where it's docked in case of emergency.

- Personal property coverage: Personal property is usually covered under your homeowners policy, even when the boat isn't at your house. However, your deductible is often higher, so you can add personal property coverage on your boat policy to avoid a homeowners claim.

- Wreckage and fuel removal: Reimburses cost to recover or destroy wreckage and fuel if you get in an accident.

- Replacement cost or agreed value: Newer and more expensive boats can be insured for agreed value, which means you'll recover the full amount you paid for it, without depreciation.

- Pet coverage: If you boat with a pet on board, this provides up to $1,000 towards veterinarian fees if they're injured on the boat.

An independent insurance agent can recommend the additional boat insurance coverages that are a good match for you.

What Is Boat Rental Insurance Coverage?

Boat rental insurance is often required by boat rental companies to protect against lawsuits that may arise when you operate a rented vessel. If a third party sues you for claims of bodily injury or property damage when you're operating a rented boat and you don't have boat rental insurance, you'll have to pay out of pocket for your defense and settlement costs.

What Boat Insurance Will Pay For

Before settling on a boat insurance policy, it's important to understand just what it will reimburse you for and what it won't. Here's a breakdown for further clarification.

| Boat insurance pays for: | Boat insurance won't pay for: |

|---|---|

| Physical damage due to covered causes like theft, fire, etc. | Maintenance costs. |

| Physical damage to the boat and anchors or other equipment. | Machinery damage or defective equipment and boat components. |

| Medical expenses for those injured on or by your boat. | Medical expenses relating to shark bite injuries. |

| Property damage to others caused by your boat. | Property damage caused by insect infestations, mold, barnacles, etc. |

| Liability issues that arise when someone else drives your boat with permission. | Intentional harm caused to others with your boat. |

If you still have questions about what's covered or not covered by boat insurance, your independent insurance agent can help.

Finding Discounts and Savings on Boat Insurance

Fortunately, there are typically several discounts available for boat insurance. While options vary by insurance company, here are some common discounts:

- No claims history discount: If you've never filed a claim on your boat insurance, your carrier is likely to reward you with a discount over time.

- Diesel-powered boat discount: Some boat insurance companies offer discounts for watercraft with diesel-powered engines.

- Safety course discount: You might be eligible to receive a discount on your boat insurance if you complete a state-approved safety course.

- Bundling discount: Often you can save money on boat insurance if you bundle it with another type of coverage, such as home insurance, through the same carrier.

An independent insurance agent is your greatest ally when it comes to finding discounts on boat insurance.

Why Choose an Independent Insurance Agent?

Independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut through the jargon and clarify the fine print so you know exactly what you’re getting.

Independent insurance agents also have access to multiple insurance companies, ultimately finding you the best boat insurance, accessibility, and competitive pricing while working for you.

More Choices

Our independent insurance agents work for you, not the insurance companies. That means you always get the best coverage options to choose from.

Better Prices

When you have options from multiple companies, it's easier to find the best coverage at the right price, at no extra cost to you.

Local Services

There's an independent agent in every city who always understands the insurance coverage you need most based on local laws and needs that apply to you.

What our customers are saying

Work Done For Me

I looked at different individual companies, but it was so time-consuming to fill out each individual application and keep track of them all. Trusted Choice got back to me quickly and gave me an option that worked. I ended up with Travelers, which has a great price. The online process was pretty easy. Plus, they did the legwork for me. It was a great experience.

Multiple Options

I tried finding insurance myself but I wasn't coming up with very much. I contacted Trusted Choice and they looked at various options and presented it to me. Everything with the agent went very smoothly... He knew exactly what we wanted and searched accordingly. I was able to choose the one that I thought was best so it worked out for me. I'm happy that I did it that way.

I needed insurance for the home that I was buying and based on the pricing, I went with Trusted Choice. The process was all done online and I didn't really have to do too much. The website was also easy to use and navigate and it was not overly intimidating. Everybody that I've dealt with also seemed good and professional. It was a positive experience.

One-On-One Attention

Every year I search for insurance to make sure that I’m getting the best bang for my dollar. I went with an independent agent because if I go through them, I get that one-on-one instead of being just a number.... The experience was great.

Really Helpful

TrustedChoice.com was real helpful when I needed to get insurance. The agent gave me the basics of what I'd be getting if I got insurance with them.

Multiple Agents

I needed a different independent agent to get insurance and I went with Trusted Choice. Their website was helpful in connecting me to two or three other agents that I was able to speak to. Their site did what I needed.

More Coverage

Trusted Choice's online process is super easy. They pulled most of the information and I ended up going with one of their recommendations. Aside from them, everybody else was too expensive. Plus, the Trusted Choice agent offered more coverage.

Great Match

Everybody at TrustedChoice.com was helpful and pleasant. They set us up with a great match and gave us our best option and price.

Best Coverage and Rates

I did a lot of searching for insurance and I went with a Trusted Choice agent because they provided the best rates and coverage. I haven't had a claim but I know I'm covered and that's good news. I would recommend Trusted Choice.

Welcome to Progressive Insurance®

Better insurance starts here

Select a product to quote

Bundle & Save

Auto + home, renters or condo

Average savings of nearly $750 *

Home, renters, condo & more

Recreational

Motorcycle, RV, boat & more

Term life, whole life & more

Or, see all 30+ products

- Continue previous quote

- Find an agent

We're the #1 combined personal and commercial auto insurance company ‡

From customized auto insurance to superior claims service, our people and technology will support you every step of the way. Join us today and experience why we're one of the best insurance companies.

Nearly $750 * Disclosure

Average annual savings for drivers who switch to Progressive and save.

35 million+

People trust us to insure what's important to them.

Day or night customer support for all your questions and concerns.

Learn more about our insurance products and coverages

At Progressive, we've built our business around understanding what you need and what's important for you to protect. That's why we offer a wide range of insurance products to meet your specific needs, including customized coverages.

Auto insurance

Buckle up with protection you can rely on.

Bundle auto and property insurance

Bundle with Progressive and save more — it's that easy!

Motorcycle insurance

Hop on — we're the #1 motorcycle insurance company in the U.S.

RV insurance

Hit the highway with the coverage you need for peace of mind.

Life insurance

Give your family protection and long-lasting financial security.

See why we're Progressive

Yes, we're an insurance company, but find out what makes us stand out.

Combine home and auto insurance for more savings.

Diversity & Inclusion

Progress – it’s in our name and in our approach.

Dr. Rick in France

Get tips on how to not act like your parents while traveling.

Join one of Fortune's 100 Best Companies to Work For.

Monday - Friday: 8:00am to 8:00pm Eastern Time

Bundle and save an average of 5% on auto! Δ

- Auto + Home

- Auto + Condo

- Auto + Renters

Or, quote another product

- Car Loan Refinancing

- Car Shopping

- Classic Car

- Compact Tractors

- Debit Cards for Kids

- Electric Bikes

- Electronic Device

- Home Security

- Home Warranty

- Mechanical Repair

- Mexico Auto

- Mexico Boat & Watercraft Insurance

- Mobile Home

- Mortgage Refinance

- Personal Loans

- Wedding & Event

Nearly $750 average savings for new customers who save *

With Progressive auto insurance, you'll enjoy affordable coverage options and a variety of discounts. Plus, you can get a quote in just a few minutes – get started now and enjoy peace of mind behind the wheel.

Why Progressive?: We guarantee repairs for as long as you own or lease your vehicle when you take it to one of our network shops.

Bundle and save an average of 7% on auto! Δ

Simply quote auto and homeowners insurance and you could earn a multi-policy discount. Δ Plus, with both policies under one roof, you can update or make changes to your insurance with ease. Quote now to get started.

Quote now & get covered for as low as $100/year **

With Progressive, you can take your boat to any lake or river, plus ocean waters within 75 miles of the coast. And we offer a variety of coverages to protect your boat and the good times that come with it. Quote now to get started.

Why Progressive?: With on-water towing, fuel spill removal, mechanical breakdown coverage, and more, you can float on without worry.

Get the coverage you need to keep your business growing

From general liability to cyber insurance, you can find the coverages you need to protect your company from severe financial loss. Start a quote today and safeguard your business from the unexpected.

Get customized coverage for your commercial vehicles

Progressive has the coverages you need to protect your vehicles on the road and at the job site. We provide insurance for a wide range of commercial vehicles, including trucks, trailers, cars, SUVs, and more. Start your quote today and give yourself peace of mind while on the clock.

Why Progressive?: We offer a variety of discounts to help your business save more.

Cover yourself for everything your condo association doesn't

Your home's structure may be protected, but what about everything inside? With condo insurance, you can be covered for theft, damage, and more. Get a quote today for greater peace of mind.

Why Progressive?: We cover your belongings, temporary living expenses, home upgrades, and more so you don’t have to worry about gaps in coverage.

Safeguard your most valuable asset

Protect your home, belongings, and financial security with homeowners insurance. With a variety of coverages, and plenty of ways to save, you can create a policy that keeps your home safe and fits your budget. Get a quote today.

Why Progressive?: You can instantly compare rates and coverages from multiple companies side-by-side to find the right policy for you.

Give your family the safety net they deserve

Term life insurance can provide you and your family with long-lasting financial security. You determine how much coverage you need, how long you need it, who you’d like covered, and when you pay—giving you control of your policy. Quote now to get started.

Build a mobile home policy that works for you

With a range of coverages and deductible options to choose from, you can easily create an insurance policy that protects your mobile home and works with your budget. Start building your policy today.

Why Progressive?: We offer specialized protection to cover porches, garages, gazebos, and more.

Ride with the #1 bike insurer starting at $75/year §

If you enjoy the freedom of the open road, then you'll love the freedom of choice we give you with our coverages. Start your quote now and create a custom policy that protects your ride wherever the road takes you.

Why Progressive?: Your bike will stay just the way you like it. We use OEM parts for all repairs.

Pet insurance

Affordable coverage for your four-legged friend

With Progressive Pet Insurance by Pets Best, you can create a plan that fits your dog or cat's needs, as well as your budget. Simply choose a plan and then customize your deductible, reimbursement percentage, and annual limit.

Protect yourself from damage, theft, and more

With renters insurance, your belongings are protected whether they're in your apartment, backseat, or storage locker. Plus, if you can't stay in your residence due to a covered incident, we'll help pay for your temporary living expenses. Get covered today.

Why Progressive?: You can get a renters policy for less than $1 per day. ‡‡

Join a leading RV insurer starting at $125/year ††

Whether you're a full-time RVer or an occasional road-tripper, you'll find all the coverages you need at an affordable price right here. Get a quote now and enjoy the open road without worry.

Why Progressive?: From windshield & glass coverage to emergency expenses, we have your road trip covered.

Umbrella insurance

Extra coverage for all your assets

Umbrella insurance provides an extra layer of liability coverage beyond what your home and auto policy offer, with limits available up to $5 million.

Bundle and save an average of 7% on auto! Δ

When you combine Progressive auto and condo insurance, you could earn a multi-policy discount. Δ And with those extra savings comes the convenience of managing both your policies through one company. Quote now to see the savings.

Bundle and save an average of 3% on auto! Δ

With both an auto and renters policy, you could earn a multi-policy discount. Δ Plus, you'll enjoy the convenience of having both policies under the same roof. Quote now to enjoy the extra savings and ease of bundled insurance.

- Resources for agents

- E&S/Specialty partners

- Financial professionals

- Enterprise partners

- Career seekers

Vehicle products

- Classic car

- Personal watercraft

- Business auto

- Auto & home

Related tasks

- Start an auto claim

- Find an agent

- Get insurance card

- Vehicle insurance FAQ

- Vehicle loans

- All insurance

Property products

- Business property

- Home & auto

- Renters insurance FAQ

- Property insurance FAQ

- Home financing

- Renters discounts

Personal Products

- Life insurance

- Pet insurance

- Identity theft

Related links

- Pet insurance FAQ

- Travel insurance FAQ

- Personal loans

Business products

- Businessowners policy (BOP)

- General liability

- Workers’ compensation

- Farm & ranch

- Commercial agribusiness

- See products ...

- Excess & surplus

- Management liability & specialty

- Surety bonds

Employee Benefits

- Employee retirement plans

- Group benefits

- Key person benefits

- Medical stop loss

- MedPair supplemental health

By business type

- Auto service & repair

- Contractors

- Food service

- Professional offices

- Retail stores & services

- Wholesalers & distributors

Related Tasks

- Find a farm agent

- Business claims FAQ

Investment products

- Personal retirement plans

- Mutual funds

- Exchange-traded funds

- Find a financial professional

- Personal finance FAQ

- Investing & retirement FAQ

- Nationwide Financial

- The Advisor Advocate® blog

Insurance Resources

- Small business

- Powersports

- Personal finance

- Investments

- Emergency planning

- Farm & agribusiness

- Cyber resource center

- Investing FAQ

- Now from Nationwide®

- Agency Forward®

Boat insurance

Let us protect your fishing boat, sailboat, pontoon boat, ski surf boat or other recreational boat valued up to $350,000.

Boat insurance coverages and discounts

What we cover.

Protect your boat in and out of the water, as well as yourself and others.

Boat insurance packages

Save when you buy a package for the type of boating you do.

Boat insurance discounts

Make boat insurance more affordable.

Get the boat insurance coverage you need

Get a boat insurance quote and discover competitive rates on the coverage you need. Our affordable policies help you keep your boat protected on the road and on the water. Before your next outing on the water, make sure you have the best coverage for your needs. Our policies include comprehensive, liability and coverage options at affordable rates, so you can customize the protection you need for your boat and your passengers.

Get started on a free boat insurance quote today by finding a local agent or by calling us at 1-866-603-9273 .

Superior claims service

Our specialized servicing group is dedicated to taking care of your specific powersports needs.

File a claim

Related topics & resources

Insurance terms, definitions and explanations are intended for informational purposes only and do not in any way replace or modify the definitions and information contained in individual insurance contracts, policies or declaration pages, which are controlling. Such terms and availability may vary by state and exclusions may apply. Discounts may not be applied to all policy coverages.

- Auto and Vehicle

- Boat and Watercraft Insurance

Boat insurance quotes

Save on boat insurance, customized for you..

For many boat owners, boats and watercrafts are a way of life. That's why it's important to make sure you and your boat are protected.

We can help you get the boat insurance coverage you need at a great price. Start your free boat insurance quote today to see how much you can save when you only pay for what you need.

Save money with these boat insurance discounts

You may qualify for a Boat Course Discount if you or a member of your household have completed an approved boat safety course. 1

You can save up to 5% on your premiums if you've owned any boat for two or more years. 1

You could save when you bundle your auto and boat insurance. 1

Bundle your insurance, more like bundle of savings!

Customized boat insurance coverage built for you, liability coverages, physical damage coverage, other coverage, why choose liberty mutual for boat insurance, get the liberty mutual app today.

The fastest, easiest way to manage your insurance.

Access your ID cards 3 Save your ID cards to your device so you have them where you need them, when you need them.

Pay and manage bills Pay your bills, enroll in Autopay, and update billing preferences in a few easy taps.

File and track claims From requesting Roadside Assistance to filing a claim in minutes, we're here when you need us.

Common questions about boat insurance

What does boat insurance cover.

There are a lot of boat insurers and watercraft insurance companies you can choose from. A few things to keep in mind are what coverage you need and the reputation of the company. Enjoy the water with peace of mind knowing you and your boat are protected from the unexpected. We can help you with things like 4

- Loading... Damage to your boat

- Loading... Damage to someone else's property

- Loading... Boat accessories

- Loading... Emergency services, such as on-water towing

- Loading... Theft 5

What other kinds of watercraft can I get insurance for?

We also insure these other types of watercraft

- Pontoon boats

- Fishing boats

- Personal watercraft (PWC)

Do I need boat insurance?

If you have a boat, watercraft, or yacht, it's a good idea to have some type of watercraft insurance to help protect you and your assets financially from any injuries or damage caused while boating. The question to ask yourself is whether you can afford to pay out of pocket for damages and/or injuries caused by an at fault accident?

That being said, most states don't legally require you to have boat insurance (except Arkansas and Utah). Just be sure to check with the state where you'll be boating.

There are some cases where you may be required to have insurance on your boat like

- You financed your boat and the lender requires insurance

- You go to or use ports, marinas, or storage facilities that require insurance

It's important to check with places you visit or plan to visit with your boat to make sure you know any restrictions or requirements.

Does my homeowners insurance cover my boat?

Some homeowners policies may provide limited coverage for boats. However, even if it does, it'll probably be limited with restrictions when it's off your property and/or on the water. That's because homeowners insurance isn't meant to protect a boat on the water.

Many homeowners policies also have limits on

- Watercraft size

- Location of any incidents

- Limits on Liability Coverage (if any), and more

Check your policy and be sure to purchase any additional coverage you may need.

Regardless of where your mooring is, or whether you've financed your boat or not, you'll want to be covered in the event of an accident. Boats and watercrafts are big investments that should be protected. A boat insurance policy helps protect you and your boat from things like

- Physical Damage

- Fuel Spill Liability

- Medical Coverage for you or passengers in your watercraft

- Damage to another craft or structure, and more

How much is boat insurance?

The cost of boat insurance depends on many factors, including where it's kept, its value or cost, optional coverages, and more. For example, it may be cheaper to cover a 10 foot single engine boat compared to getting yacht insurance for a million dollar boat.

While getting the cheapest boat insurance sounds great, it could cost you when you need it most. We can help you get the boat insurance you need at a great price. The best way to find out the cost is to get a boat insurance quote by calling us at 800-295-2568.

How should I compare boat insurance quotes?

It's always a good idea to get a few boat insurance quotes to help compare. Whether you're looking to buy boat insurance today or shopping to compare boat insurance prices, we can help you find what you need. When comparing boat insurance quotes from multiple companies, be sure to compare similar coverages, limits, and deductibles.

Is there a discount for taking a boat safety course?

Yes. You may qualify for a Boat Course Discount if you or a member of your household have completed an approved boat safety course. You may also qualify for a discount for being an active member of the US Power Squadron or an active member of the US Coast Guard Auxiliary.

Please note, to qualify for this discount you'll need to submit a copy of the boat course certificate of completion.

Are my boat accessories covered under my boat insurance policy?

Yes, accessories in the boat may be covered under your boat insurance policy.

Examples of things that can be covered include

- Life preservers

- Fire extinguishers, and more

Want to learn more about insurance? We can help!

Boat Insurance Coverages

Coverage simply isn’t the same everywhere. We offer many of the same standard coverages other insurers do. But we do more than meet checklist requirements. We offer more unique boat insurance coverage options—many of which don’t cost extra.

Standard boat insurance coverages and benefits

Full replacement cost.

If you carry boat comprehensive and collision coverage , we’ll pay what it costs to return your watercraft to its pre-accident condition or better.

Example: You hit a submerged object, damaging your 10-year old motor. It may only be valued at $3,000 but costs $8,000 to replace. If we can’t repair it, we’ll replace it. This saves you $5,000 in depreciation.

Bodily injury & property damage liability (BI/PD)

Bodily injury liability covers you if you’re in a boat accident and liable for injuring others. Liability boat insurance also pays to repair or replace any watercraft, object or other property you damage while boating, plus legal expenses if you’re sued.

Example: You crash your boat into the pier when trying to dock it, causing thousands in damage and injuring people on the pier. Liability will pay for the pier damage and people’s injuries up to your policy’s limits.

Progressive pays for fuel spills, no matter how the spill happened: sunken boat, leaking tank, or a mishap at the fueling station.

Example: Your boat sinks in a nature reserve and the government issues you a fine-claiming your fuel spill threatens marine life and makes the water unsanitary. Progressive will pay the fine up to your policy’s limits.

Wreckage removal

If your boat sinks, we’ll cover the cost of removing your boat from the water (if removal is legally required).

Example: In a heavy storm, your docked boat sinks, so the marina mandates that you remove it or pay a fine. We’ll take care of removing your boat, so you can avoid any fees.

Roadside assistance

This coverage comes standard if you have trailer coverage on your policy—we’ll pay to tow your disabled vehicle to the nearest repair shop. See how boat roadside assistance works .

Example: You’re hauling your boat to the lake, and your vehicle breaks down or runs out of gas. We’ll pay to tow your vehicle and watercraft to the nearest repair shop.

Water sports coverage

Water sports coverage pays for any injuries or damages you caused from tubing, knee boarding, wake boarding, wake surfing or other similar activities. Parasailing, kite boarding or other activities in which someone is pulled through the air won’t be covered.

Example: Your child’s friend is injured while tubing on your boat. Water sports coverage will kick in and pay for their medical bills up to your policy’s limits.

Optional boat insurance coverages

Total loss replacement.

Available for purchase if you’re the original owner of your boat and it’s no more than one model year old. If your boat is totaled within 5 model years, we’ll buy you a new one or give you the amount that you originally paid for your totaled boat—your choice. If you’re outside the 5 model-year window, we will still give you the original purchase price of your boat.

Example: You bought a new boat 3 years ago for $15,000, but it’s now only worth $10,000. If you have a total loss, it’s going to cost you at least $15,000 to buy a brand new one. So, we’ll spend the $15,000 and save you $5,000 in depreciation.

Sign & Glide ® on-water towing

If your boat is disabled or breaks down on the water, boat towing insurance pays for on-water towing, jump starts, soft un-groundings, and fuel delivery if your boat is disabled on the water. Just call our dispatch center, and we’ll arrange for and pay the tow operator directly. You pay nothing out of pocket for boat towing service. See how Sign & Glide works .

Fishing equipment or carry-on items

For lost or stolen items, you can get replacement cost, meaning no depreciation is taken, for up to $10,000 on fishing equipment, such as your tackle box or fishing pole. You may also receive replacement cost value, up to $10,000, for personal effects such as scuba gear, phones, or other items that you carry on board.

Example: $1,000 worth of fishing equipment is stolen from your boat, but it’s a few years old and only worth $500. Progressive pays what it costs to buy brand new equipment (of similar models).

Propulsion Plus ® mechanical breakdown coverage

We’ll pay to repair or replace the lower unit of an outboard motor, or upper & lower units of an inboard/outboard motor if you have a mechanical breakdown. And yes, we’ll still cover it if it’s caused by general wear and tear. Starts at $38/year. Propulsion Plus does not apply to jet drives or inboard motors.

Example: Your 10-year old lower unit simply runs its course and dies on you. Typically, insurance wouldn’t pay for that because wear and tear is not covered. This coverage is different. Add Propulsion Plus, and, if it can't be repaired, we'll replace it .

Comprehensive & collision

These are two separate coverages. Comprehensive covers events out of your control, such as theft, vandalism, sunken boat, fires, heavy winds, hurricanes, and other weather-related damage. Collision covers damage from boating accidents, such as hitting a submerged object, dock, another boat, and even covers any injuries to pets on your boat, etc.

Example: Heavy winds rip the sails off your boat, causing thousands in damage. If you have comprehensive, we’ll pay for the damage, minus your deductible.

Example (Collision): You hit a submerged object and damage your boat and your dog is hurt in the accident. We’ll pay for damage to your boat, minus your deductible, and injuries to your dog (up to $1,000).

Uninsured/underinsured boater (UB/UIB)

If you’re hit by a boater with no insurance or not enough insurance, UB/UIB will pay for your injuries and damages up to your policy’s limits.

Example: Another boater without insurance hits you and injures everyone on board. The boater is uninsured and can’t afford to pay out-of-pocket for the injuries caused. UB/UIB will pay for what the boater is liable for, up to the limits you select.

Medical payments

You can pick a range of coverage limits to pay for you and your passengers’ medical bills if you’re in an accident or someone is hurt on your boat.

Example: You’re fishing and accidentally cut your hand with a sharp hook. You need stitches and have an expensive medical bill. Your health insurance company says they won’t pay the bill because you haven’t reached your deductible. So you can instead use your medical payments coverage, which has no deductible.

Trailer trip interruption

Pays your expenses if you break down at least 100 miles from home. We’ll reimburse you up to $500 to cover food, hotel, and other transportation costs. Costs only $10/year.

Why you need specialized boat insurance coverage

Boat insurance is not required in all states. However, if you finance your boat or dock it at a marina, you may be required to have a specialty boat policy. Get more information on boat insurance requirements .

Off the water, you may be able to insure your boat on your homeowners insurance policy . But homeowners policies typically cover small low-powered watercraft and offer few optional coverages. That’s why so many boaters choose Progressive specialized policies. With us, you’ll get all the coverages listed above (or the option to select them).

Quote boat insurance and be covered for as low as $100/year *

Get a quote Or, call 1-855-347-3939

Monday - Friday: 8:00am to 8:00pm Eastern Time

Bundle and save an average of 5% on auto! Δ

- Auto + Home

- Auto + Condo

- Auto + Renters

Or, quote another product

- Car Loan Refinancing

- Car Shopping

- Classic Car

- Compact Tractors

- Debit Cards for Kids

- Electric Bikes

- Electronic Device

- Home Security

- Home Warranty

- Mechanical Repair

- Mexico Auto

- Mexico Boat & Watercraft Insurance

- Mobile Home

- Mortgage Refinance

- Personal Loans

- Wedding & Event

- 1.888.695.4625

- 1.800.952.8699

- 1.844.719.2120

- 1.844.403.1464

- 1.833.548.1292

- 1.844.754.0044

- 1.888.342.5977

Boat or Yacht Insurance

ZIP code is required and must be 5-digits

Travel protection is offered by our trusted partner, Travel Insured International, through InsuraMatch, LLC, a Travelers-owned insurance agency.

InsuraMatch

InsuraMatch is a Travelers-owned insurance agency that sells insurance policies for various insurance companies. It receives commissions on the insurance policies it sells from these insurers and may receive other performance, profitability or volume-based compensation from the insurers. This compensation may vary by insurance company. For more information please visit InsuraMatch .

Pet insurance is offered by our trusted partner, PTZ Insurance Agency, Ltd through its ASPCA ® Pet Health Insurance program via InsuraMatch, LLC, a Travelers-owned insurance agency.

ZIP Code is required and must be 5-digits

Motorcycle insurance is offered by our trusted partner, Dairyland ® , through InsuraMatch, LLC, a Travelers-owned insurance agency.

Flood insurance is offered by our trusted partner, Neptune Flood, through InsuraMatch, LLC, a Travelers-owned insurance agency.

Make sure your boat and everyone on it are properly protected with Travelers.

For all the boating adventures ahead

Get a boat or yacht insurance quote today and get ready to enjoy more of what you love – time out on the water with friends and family. Make sure your boat and everyone on it are properly protected with Travelers .

How much is boat insurance?

Boat insurance costs vary based on the state where you use your boat and the coverage options you select. For instance, boating insurance option s – such as agreed value policies – will generally cost more than actual cash value policies. If keeping boat insurance costs down is a priority, choosing a higher deductible can reduce your policy premium. Depending upon the state where the boat is used, boat insurance policies can be purchased at a very reasonable price.*

Why do I need boat insurance?

You need boat insurance to cover loss or damage to your boat and to help protect you financially for injuries or damage caused by covered mishaps.

Liability coverage in your boat insurance can help protect you if you cause injury to others or damage their property while using your boat.

Medical payment s coverage provides reimbursement for injuries to you and your guests. Boat or yacht insurance even covers on-water towing.